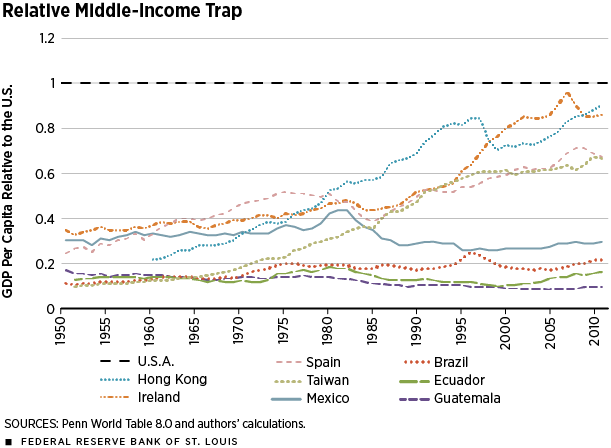

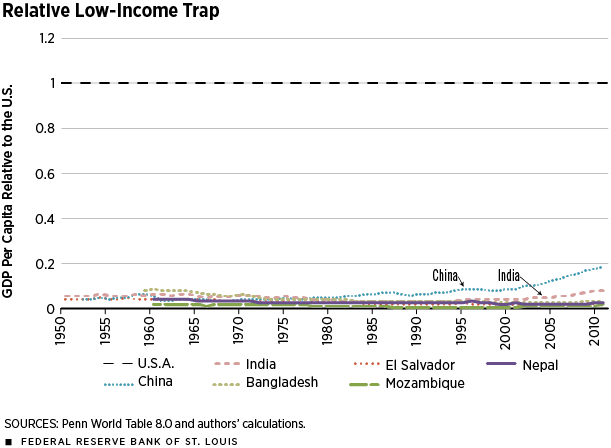

So how is that process of convergence actually coming along Maria A. Arias and Yi Wen offer some fact and analysis in "Trapped: Few Developing Countries Can Climb the Economic Ladder or Stay There," which appears in the October 2015 issue of the Regional Economist, published by the Federal Reserve Bank of St. Louis (pp. 4-9). Consider a couple of figures showing where some convergence has happened in the last 60 years--and where it has not.

First, consider countries that were "middle income" by global standards in 1950--that is, their per capita incomes at that time were between roughly 10% and 40% of the US level. On the figure, the US level of per capita GDP is used as the baseline, represented by 1, and the per capita GDP of other countries is expressed relative to that baseline. The rising lines show some examples of convergence: Hong Kong, Ireland, Spain, and Taiwan. Other examples would include some countries of east Asia like South Korea. But the other four countries, all from Latin America--Mexico, Brazil, Ecuador, and Guatamala--have seen at best a very modest force of convergence over the last 60 years.

The low-income countries of the world back in 1950, those starting at well below 10% of the US level of per capita income, show a mixed pattern as well. In the figure below, the recent rise of China and India are put in perspective. In terms of per capita GDP, they have now reached the lower part of "middle-income" by global terms. But a number of other low-income countries around the world haven't shown much convergence. The examples given here, which can be thought of as representing other low-income swaths of south Asia, sub-Saharan Africa, and Latin America, are Bangladesh, El Salvador, Mozambique, and Nepal.

More systematic evidence shows that countries often remain in the low-income and middle-income positions for a long time. By their calculation based on all the countries for which estimates are available (references to tables omitted):

The probability of remaining trapped in the low-income range is 94 percent after 10 years 90 percent after 20 years and 80 percent in the entire observational period, 30 to 61 years. ... [T]he probability of escaping the middle-income trap is 11 percent after a 10-year period, 21 percent after a 20-year period and 36 percent after 30 to 61 years. Also interesting to note is that countries almost never degrade to low- or middle-income status once they have reached the high-income status: The probability of remaining at a high-income status is at least 97 percent.One of the central questions of development economics is: "What is holding back convergence?" It's easy to come up with theories. For example, low-income countries might have economic or political institutions that aren't conducive to growth. For example, perhaps they don't offer support for the rule of law or private property in a way that helps economic growth. Or perhaps political elites in a low-income country would rather control and sometimes close off interactions with the rest of the world, rather than open up to the world and risk that alternative centers of power and wealth might form. But as the authors point out, many of these explanations are at best partial, and it's not hard to think of exceptions to whatever rule you have formulated.

All of which leaves me with a few thoughts:

1) It doesn't seem quite right to argue that countries are "trapped" in their current level of income. Aart Kraay and David McKenzie make a persuasive case for skepticism about this view in their essay "Do Poverty Traps Exist? Assessing the Evidence," in the Summer 2014 issue of the Journal of Economic Perspectives. They point out that while there has been a lack of convergence, the world's poorest economies circa 1960 actually have growth at about the same rate as the world's higher-income economies since then. Moreover, whatever kind of "trap" exists apparently applies not just to the poorest countries, but also to middle-income countries and high-income countries--which rarely switch their positions, either.

2) The take-off of China and India from low-income toward middle-income status is a phenomenal change. These countries each have populations over 1.2 billion, and together they represent something like one-third of the world population. Their growth in recent decades suggest that we need to rethink our beliefs from a few decades ago about countries being stuck. I find myself wonder if something about the huge size of these countries has perhaps helped their growth. Maybe once a large-population country gets its economy rolling, it has more sustained momentum than would a small-population country that took similar steps.

3) As a way of thinking concretely if anecdotally abou this issue, Arias and Wen compare two middle income countries: Ireland, which has experienced convergence in recent decades, and Mexico, which has not. Both countries are near high-income countries. They give Ireland credit for its willingness to be open to foriegn direct investment, which helped link it to the global economy, as well as for its investments in education and its ability (most of the time) to avoid high government budget deficits or inflation. In contrast, Mexico for many decades focused mainly on exporting oil, while its government did not invest heavily in education and instead ran up large debts and periods of high inflation. These kinds of differences surely aren't a full description of why one country converges and another doesn't, but it's a start.

4) My own sense, for what it's worth, is that convergence is in some substantial way a broad national commitment to welcome extensive and continual change. Sustained economic growth will shake up the lives of people in low-income and middle-income countries: not just what they can buy, but what jobs they do, what their living spaces look like, how their children will be educated, ties with family, what firms prosper or go under, and an ongoing transformation of villages, towns and cities. CNo nation can have a genuine commitment to sustained and powerful economic growth if it doesn't also have a broad-based willingness to to experience extensive change. But change is disruption, and disruption involves losses as well as gains.