People all over the world economy are in "vulnerable" jobs, which the International Labor Organization defines as "own-account work and contributing family employment"--that is, you're working for yourself or for your family, rather than for an employer. Not surprisingly, the desire to emigrate is high in many parts of the world, and seems to be on the rise. Here are two figures from the World Employment and Social Outlook: Trends 2017, published in January 2017 by the International Labour Organization.

For starters, here's a figure showing some employment patterns across the world. The first panel shows that the official unemployment rate doesn't look all that dramatically different across developed, emerging, and developing economies. The big difference is the "vulnerable" employment rate, which is about 10% in developed economies, nearly half the workforce in emerging markets, and more than three-quarters of the workforce in developing countries. As ILO notes, "these workers have less access to social dialogue and are less likely to exhibit job security, regular incomes and access to social protection than their wage and salaried counterparts."

The bottom panel shows the share of workers living in extreme or moderate poverty, which is defines as iving on less than US$3.10 per day. In emerging countries, this is nearly one-quarter of all workers; in developing countries, it's about two-thirds of all workers.

It's no surprise that many people who are staring these economic prospects in the face would be willing to relocate to another country. The bars and dots show the share of people in each region who answer that they would like to move to another country, in answer to the question: “Ideally, if you had the opportunity, would you like to move permanently to another country, or would you prefer to continue living in this country?” The bars are for the year 2009; the dots are for 2016. Thus, for regions of the world other than North America, Southern Asia, and Southeastern Asia, share of people who would be willing to move if they had a chance is typically more than 15-20%.

Pages

▼

Tuesday, February 28, 2017

Monday, February 27, 2017

The Declining US Labor Share, Explicated

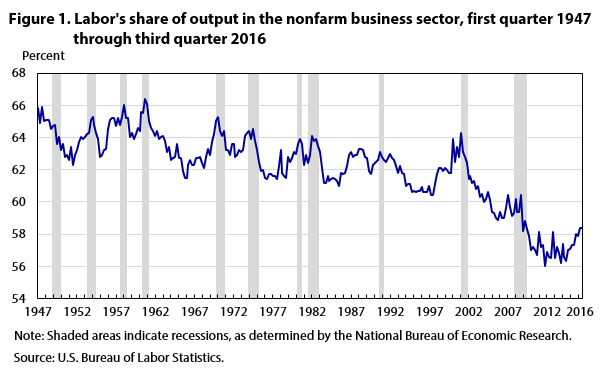

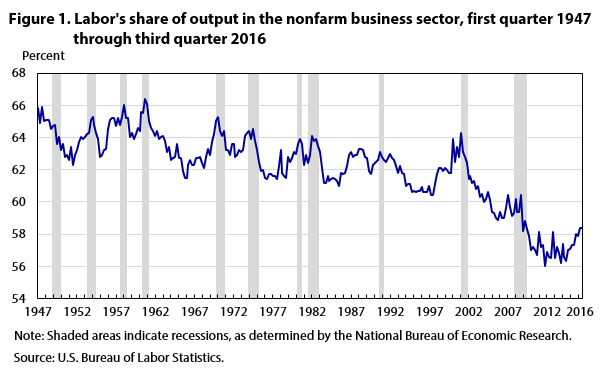

One of the most striking and troubling patterns in the US economy in recent decades is the "declining labor share: that is, the pattern that the share of the value of output (in the nonfarm business sector) that goes to workers in the form of compensation, which includes benefits as well as wage and salary compensation, has been dropping. The labor share was typically in the range of 63-65% from the 1950s into the early 1970s. By the 1980s and 1990s, it was more often falling in the range of 61-63%. In the early 2000s, it fell below 60%, and since the end of the Great Recession in 2009 it has typically been between 56-58%.

This falling labor share is not some statistic recently created and promoted by partisan sources. It's calculated by the US Bureau of Labor Statistics, using a methodology that has remained more-or-less standard over the years. Two economists at the BLS, Michael D. Giandrea and Shawn A. Sprague, explain "Estimating the Labor Share" along with an overview of research findings on the issue in the February 2017 issue of the Monthly Labor Review.

As a starting point, here's their figure showing labor's share:

For example, the authors write: "Karabarbounis and Neiman examined data from more than 50 countries and argue that the decline in the relative price of investment goods—in particular, computerized capital—has led firms to employ more capital and relatively less labor. They find that this shift has been responsible for approximately one-half of the observed decline in the labor share."

The underlying assumptions about "proprietor income" are biasing the labor share calculations.

The calculation of labor share involve adding compensation received by employees to "proprietor income," which is the labor income received by those who run their own business. However, proprietor income is conceptually tough to measure, because someone who owns their own business can receive both "labor income," as if the person was an employee of their own business, and "capital income," as the owner of the business. In the real world, these two types of payments are jumbled together. To address this issue, the Bureau of Labor Statistics has assumed that the hourly labor compensation of proprietors is the same as that of employees. However, if the labor income of proprietors is actually rising over time, then this assumption means that the labor share is understated. One study finds that about one-third of the observed decline in labor share is due to this assumption that the hourly labor compensation of proprietors is the same as that of employees, rather than using an alternative method that tries to estimate the capital income of proprietors directly.

Increased imports of labor-intensive goods.

A rise in imports of more labor-intensive goods means that production in the US economy will tend to be focused on less labor-intensive goods, which should tend to drive down the labor share. Teh authors cite work by Elsby, Hobijn, and Şahin concerning "an increased reliance on imported inputs used in domestic production, especially inputs that have labor-intensive production processes. These `offshored' inputs are typically produced in countries with lower labor costs, resulting in an overall reduction in the price of domestically produced final goods."

Different industries have different labor shares, so shifts in which industries are larger or smaller can affect labor share.

This falling labor share is not some statistic recently created and promoted by partisan sources. It's calculated by the US Bureau of Labor Statistics, using a methodology that has remained more-or-less standard over the years. Two economists at the BLS, Michael D. Giandrea and Shawn A. Sprague, explain "Estimating the Labor Share" along with an overview of research findings on the issue in the February 2017 issue of the Monthly Labor Review.

As a starting point, here's their figure showing labor's share:

There seems to be a slow decline in the labor share from the 1960s though the 1990s, which is briefly interrupted by a dot-com bounce at the 1990s, and then turns into a faster decline in the early 2000s. This pattern is part of what lies behind some other much-discussed changes in the US economy. For example, average wage increases have not matched up average productivity gains in recent decades, which is because the share going to labor is declining. A smaller labor share also has implications for the distribution of overall income, because it implies that those who receive a greater share of their income from non-labor sources, like returns on investment, are going to do relatively well.

Giandrea and Sprague offer a nice concise overview of the main hypotheses for explaining the declining labor share. The theories include:

Cheaper investment goods, like computers, are leading firms to use more capital and less labor, which reduced the labor share.

Giandrea and Sprague offer a nice concise overview of the main hypotheses for explaining the declining labor share. The theories include:

Cheaper investment goods, like computers, are leading firms to use more capital and less labor, which reduced the labor share.

For example, the authors write: "Karabarbounis and Neiman examined data from more than 50 countries and argue that the decline in the relative price of investment goods—in particular, computerized capital—has led firms to employ more capital and relatively less labor. They find that this shift has been responsible for approximately one-half of the observed decline in the labor share."

A related version of this theory is that while some new technologies should be viewed as substituting for labor, many other should be viewed as augmenting the productive power of labor. As the authors describe it: "Lawrence writes that increases in labor-augmenting technical changes essentially increase the amount of labor provided by a given number of workers, thereby decreasing labor’s share of output."

The underlying assumptions about "proprietor income" are biasing the labor share calculations.

The calculation of labor share involve adding compensation received by employees to "proprietor income," which is the labor income received by those who run their own business. However, proprietor income is conceptually tough to measure, because someone who owns their own business can receive both "labor income," as if the person was an employee of their own business, and "capital income," as the owner of the business. In the real world, these two types of payments are jumbled together. To address this issue, the Bureau of Labor Statistics has assumed that the hourly labor compensation of proprietors is the same as that of employees. However, if the labor income of proprietors is actually rising over time, then this assumption means that the labor share is understated. One study finds that about one-third of the observed decline in labor share is due to this assumption that the hourly labor compensation of proprietors is the same as that of employees, rather than using an alternative method that tries to estimate the capital income of proprietors directly.

Increased imports of labor-intensive goods.

A rise in imports of more labor-intensive goods means that production in the US economy will tend to be focused on less labor-intensive goods, which should tend to drive down the labor share. Teh authors cite work by Elsby, Hobijn, and Şahin concerning "an increased reliance on imported inputs used in domestic production, especially inputs that have labor-intensive production processes. These `offshored' inputs are typically produced in countries with lower labor costs, resulting in an overall reduction in the price of domestically produced final goods."

Different industries have different labor shares, so shifts in which industries are larger or smaller can affect labor share.

The authors write: "Declines in durable goods manufacturing and nondurable goods manufacturing were responsible for 2.8 percentage points and 1.6 percentage points, respectively, of the decline in the overall labor share. Over the same period, several industries showed gains in their labor share—led by professional and business services, which contributed 2.5 percentage points, partially offsetting the decline in the overall labor share.

These explanations all have some plausibility, but it isn't clear to me that, taken together, they adequately explain the fall of more than four percentage points in labor share in the decade or so from the early 2000s (roughly 61%) to the years right after the Great Recession (just above 56%). The labor share does show some sign of rebounding in the last couple of year, and it will be interesting to see whether that turns out to be true bounce-back or a damp squib.

Friday, February 24, 2017

The Economics of Kidnap Insurance

There is reason to be dubious, at least in theory, about how kidnap insurance can work. After all, buying kidnap insurance only makes sense if you believe that, in the case of being kidnapped, it will increase your chance of being released. After all, if kidnappers know (or can figure out) that certain people have kidnap insurance, won't they tend to target such people? Also, if a kidnap victim has insurance has insurance, won't the kidnappers demand the monetary equivalent of the earth, moon, and stars as a ransom? In these ways, might the presence of kidnap insurance increase the amount of kidnapping? On the other side, insurance companies have a profit motive to take actions that would reduce the number of kidnappings and the size of ransom payments. But if kidnappers make extraordinarily high demands and the insurance company pushes back, then it seems likely that negotiations over ransom will tend to break down--in which case the rationale for buying kidnap insurance in the first place would disappear. And how can kidnap insurance companies figure out a way to deal with the situation of kidnap victims who don't have insurance: if the representatives of those victims (who may in some cases be national governments) pay high ransoms, then it will be harder for the companies that sell kidnap insurance to keep other ransom demands down.

Anja Shortland explores "Governing kidnap for ransom: Lloyd's as a `private regime," in an article forthcoming in Governance magazine (the publisher, Wiley, has laudably made an "Early View" preprint version of the article available here). The short answer to the concerns over how kidnap insurance markets are likely to break down is that if all the companies providing that interact with each other, swap information, and follow common protocols, then kidnap insurance can function. For kidnap insurance, Lloyd's serves as a place where that interaction happens. Shortland writes (citations omitted):

Anja Shortland explores "Governing kidnap for ransom: Lloyd's as a `private regime," in an article forthcoming in Governance magazine (the publisher, Wiley, has laudably made an "Early View" preprint version of the article available here). The short answer to the concerns over how kidnap insurance markets are likely to break down is that if all the companies providing that interact with each other, swap information, and follow common protocols, then kidnap insurance can function. For kidnap insurance, Lloyd's serves as a place where that interaction happens. Shortland writes (citations omitted):

Kidnapping is a major (if largely hidden) criminal market, with an estimated total turnover of up to US$1.5 billion a year. Transnational kidnaps, where the victims are foreign tourists, high-net-worth local residents insured by multinational insurers, and the employees of foreign enterprises, are scary one-off events for almost all families and most firms. Ransoming hostages is beset with trust and enforcement problems. Kidnappers seek to maximize ransoms and can employ extreme violence to pressurize stakeholders to reveal their assets. Law enforcement may prepare rescue operations while families (pretend to) negotiate a ransom. Any sequential payment process is potentially problematic, but ransom drops can fail even if both parties act in good faith. Kidnappers need not release (live) hostages after payment and may demand multiple ransoms. Yet, despite these considerable difficulties—and contrary to general perceptions based on newspaper headlines—the vast majority of transnational kidnap victims survive and most cases conclude relatively quickly. ...

Commercially, kidnap insurance is only viable under three (related) conditions. First, kidnaps should be nonviolent and detentions short—otherwise, individuals and firms withdraw from high-risk areas. Second, insurance premia must be affordable. Although insurance is only demanded if people are concerned about kidnapping, actual kidnaps must be rare, and ransoms affordable. Insurers struggle in kidnapping hotspots: High premia deter potential customers. ... Third, ransoms and kidnap volumes must be predictable and premium income must cover (expected) losses. If kidnapping generates supernormal profits, more criminals enter the kidnap business. Premium ransoms quickly generate kidnapping booms. Insurers, therefore, have a common interest in ordering transactions and preventing ransom inflation. ...

[K]idnap insurance is indeed controlled by a single enterprise: Lloyd's of London. Yet within Lloyd's there are around 20 international syndicates underwriting kidnap for ransom insurance. The syndicates compete for business according to clear protocols regarding how insurance contracts are structured, how information is (discreetly) exchanged, and how ransom negotiations are conducted. ...

All kidnap insurance is underwritten or reinsured at Lloyd's. By setting clear parameters for commercial resolution, Lloyd's enables “fair” competition between different providers and avoids kidnap insurance being sold monopolistically. There is a protocol for insuring and resolving kidnaps, which emerged from the members themselves. Its use is mandatory and it (largely) prevents individual insurers from conferring externalities to the rest of the sector. The insurance market works smoothly because Lloyd's enables relevant case information to flow easily between insurers without compromising client confidentiality. Underwriters constantly interact with each other and individuals who do not pass (truthful) information to the Lloyd's insurance community or spread it beyond its confines can be ostracized.Shortland has compiled an array of evidence on kidnaps and ransoms from nations in Africa, Latin America, the Middle East, and elsewhere. But she also includes some specific anecdotes that tell the story of how these dynamics often work out:

The owner-manager of a Mexican company is abducted at gunpoint. A ransom of US$1 million is demanded with a threat of mutilating the hostage. His kidnap for ransom insurance is activated. A crisis response consultant coordinates a crisis management team with the hostage's brother as the only point of contact with the kidnappers. The consultant advises that previous cases in this area have settled for around US$100,000 and that “we have yet to actually receive an ear….” The brother makes an initial cash offer of US$40,000 citing liquidity problems at the firm. This is progressively raised, but in decreasing increments. After 16 days the wife tearfully pawns her engagement and wedding rings to bring the total offer to US$99,814. The kidnappers accept, the crisis responder manages the ransom drop, and the hostage is safely released.

An aid worker is kidnapped in Yemen. Unbeknownst to the family, the NGO's strategic risk management plan includes kidnap for ransom insurance. Within 24 hr, a crisis response specialist convenes a crisis management team of senior staff to conduct the negotiation with the kidnappers. He personally assures the family that “… everything will be done to ensure the timely and safe return of the hostage.” The NGO is advised to negotiate, but to stall and reject the ransom demand of US$500,000. A former SAS officer bases himself in war-torn Aden to open indirect negotiations with tribal elders. After 36 days, the local sheik indicates that the hostage could be released in exchange for a new generator for his village. The NGO agrees, the unharmed hostage is released, and the NGO operates undisturbed afterward.If you are teaching about insurance markets and need to spruce up your classroom with a fresh and vivid example of adverse selection, moral hazard, and potential spillovers, this topic and very readable article could be a useful resource.

Thursday, February 23, 2017

Wasteful Health Care Spending

The high costs of health care are not just an issue for the United States, but for countries all over the world. The OECD addresses the issue of How to Tackle Wasteful Health Care Spending in a January 2017 (which can be ordered or read online for free here). Here's a taste of the findings from the "Foreword":

For example, Ian Forde and Carol Nader contribute a chapter on "Producing the right health care:

Reducing low-value care and adverse events." They write (citations omitted):

In the general area of operational waste, Karolina Socha-Dietrich, Chris James and Agnès Couffinha contribute a chapter on "Reducing ineffective health care spending on pharmaceuticals." They summarize their article this way:

The tricky part of interpreting this figure is that administrative costs play a bigger role in private sector health insurance, and the the US has much more of its health insurance in the private sector than other countries. So if you put these together, it turns out that the US administrative expenses related to health insurance are substantially larger than in other countries.

It would of course be foolish to argue that all administrative costs are wasteful, and the report is far too sharp to make such a claim. But it is fair to say that one of the costs in the way that the US has chosen to organize its health care sector is higher administrative costs. And of course, the answer to high administrative costs often seems to be hiring another set of administrators to oversee utilization, promulgate rules for provision of care, double-check payments, and so on.

In many cases, decisions about what medical care to receive and how to deliver that care fall into a gray area. It's often not 100% clear whether a certain procedure was needed, or not needed; not 100% clear that an error was made, or whether a reasonable judgment call was made; or whether a certain administrative act is wasteful, or whether it is reasonable oversight that reduces the risk of poor care and holds down costs. But the report makes a persuasive case that a substantial share of health care spending, not just in the US but in all advanced economies, is not doing much to improve health.

Across OECD countries, a significant share of health care system spending and activities are wasteful at best, and harm our health at worst. One in ten patients in OECD countries is unnecessarily harmed at the point of care. More than 10% of hospital expenditure is spent on correcting preventable medical mistakes or infections that people catch in hospitals. One in three babies is delivered by caesarean section, whereas medical indications suggest that C-section rates should be 15% at most. Meanwhile, the market penetration of generic pharmaceuticals – drugs with effects equivalent to those of branded products but typically sold at lower prices – ranges between 10-80% across OECD countries. And a third of OECD citizens consider the health sector to be corrupt or even extremely corrupt. At a time when public budgets are under pressure worldwide, it is alarming that around one-fifth of health expenditure makes no or minimal contribution to good health outcomes. ... Actions to tackle waste are needed in the delivery of care, in the management of health services, and in the governance of health care systems.There's no magic bullet for reducing wasteful spending: instead, the strategy of the report is to pile up studies and examples until the sheer weight and number of opportunities to reduce health care spending is overwhelming. The report divides the evidence into three main categories: wasteful clinical care (care that either provides very low value or can even be counterproductive to health); operational waste (like paying excessively high prices or overusing expensive inputs like brand-name drugs); and governance-related waste (like ineffective or unnecessary administrative expenses). Here are a few words on each.

For example, Ian Forde and Carol Nader contribute a chapter on "Producing the right health care:

Reducing low-value care and adverse events." They write (citations omitted):

Health care systems still struggle to quantify the true extent of low-value care, partly because of the lack of consensus on how to define it. ... A rare exception to the lack of consensus on defining low value concerns births by caesarean section. The internationally accepted consensus is that the ideal rate for caesarean sections is between 10% and 15% of all births. No OECD countries fall within this band ...

Looking at a range of studies and evidence, they offer this list of "common areas of overdiagnosis or overtreatment":

- Imaging for low back pain.

- Imaging for headaches.

- Antibiotics for upper respiratory tract infection.

- Dual energy X-ray absorptiometry (used to measure bone mineral density).

- Preoperative testing in low-risk patients (electrocardiography, stress electrocardiography, chest radiography).

- Antipsychotics in older patients.

- Artificial nutrition in patients with advanced dementia or advanced cancer.

- Proton pump inhibitors in gastro-oesophageal reflux disease.

- Urinary catheter placement.

- Cardiac imaging in low-risk patients.

- Induction of labour.

- Cancer screening (cervical smear test, CA-125 antigen for ovarian cancer, prostate-specific antigen screening, mammography).

- Caesarean section.

The idea that errors committed by US health care providers might be the proximate cause of death for tens of thousands or even several hundred thousand people each year may seem extreme, and it is often fiercely contested by health care providers, but it is a common finding in this literature. The study they cite is from Martin A. Makary and Michael Daniel, "Medical error—the third leading cause of death in the US," BMJ 2016, 353, i2139. For a review of some earlier evidence, see my post on "How Many Deaths from Mistakes in US Health Care?" (November 12, 2015).

- A recent report suggesting that medical errors might be the third cause of death in the United States starkly calls attention to the problem (Makary and Daniel, 2016).

- International studies indicate that adverse events in hospitals add between 13% an 16% to hospital costs (Jackson, 2009) and that between 28% and 72% of them are considered avoidable upon expert examination (Brennan et al., 1991; Rafter et al., 2016, among others).

- Data on primary care are scarce, but the Primary Care International Study of Medical Errors showed that approximately 80% of errors could be classified as “process errors”, the vast majority of which are potentially remediable (Makeham et al., 2002).

In the general area of operational waste, Karolina Socha-Dietrich, Chris James and Agnès Couffinha contribute a chapter on "Reducing ineffective health care spending on pharmaceuticals." They summarize their article this way:

It starts with a discussion of perhaps the most intuitive case of waste, which occurs when prescribed pharmaceuticals (and other medical goods) are discarded unused. Next, the chapter proceeds to the foregone opportunities associated with not substituting originator drugs with cheaper therapeutic alternatives, such as generics or biosimilars. The final issue explored is whether lower prices for pharmaceuticals and other medical supplies could be obtained with more efficient procurement processes.

Chris James, Caroline Berchet and Tim Muir take up this theme in the context of hospital care, in their chapter on "Addressing operational waste by better targeting the use of hospital care." They write:

Hospitals are a crucial component of every country’s health care system, providing specialised and technical care that cannot be delivered in primary care settings. But this specialised nature means hospitals are also expensive to operate, with high personnel, equipment and other running costs. Indeed, spending on hospital inpatient care comprises an average 28% of total health spending in OECD countries. ... A well-established evidence base shows that hospitals are used more than is necessary to provide services needed by the population. That is, the treatment of patients with a number of prevalent diseases can be delivered safely and effectively at the primary care level. ...

Having timely access to care means that primary care services can respond to patient needs 24 hours a day, 7 days a week. However, this is rarely the case. Recent OECD analysis shows that a significant proportion of patients in OECD countries face barriers to accessing their PCP either because of a lack of out-of-hours (OOH) services or because of long waiting times during normal office hours. Such barriers not only lead to delays in care (and a consequent greater risk of health complications), but also higher ED [emergency department] visits and avoidable hospital admissions. Evidence suggests an inverse relationship between the ability of patients to access their PCP quickly and the likelihood of reporting an avoidable hospital admission. Indeed, access to primary care can reduce avoidable hospitalisation for chronic conditions. Conversely, poor availability to PCPs outside normal hours is the main cause of hospitalisation for ACSCs [ambulatory care sensitive conditions] ...

In the general area of governance-related waste, the essay on "Administrative spending in OECD health care systems: Where is the fat and can it be trimmed?" by Michael Mueller, Luc Hagenaars and David Morgan, includes this interesting figure comparing administrative costs across countries. The right-hand figure is a comparison of administrative costs in government health insurance programs, while the left-hand side is voluntary private health insurance programs.

The tricky part of interpreting this figure is that administrative costs play a bigger role in private sector health insurance, and the the US has much more of its health insurance in the private sector than other countries. So if you put these together, it turns out that the US administrative expenses related to health insurance are substantially larger than in other countries.

It would of course be foolish to argue that all administrative costs are wasteful, and the report is far too sharp to make such a claim. But it is fair to say that one of the costs in the way that the US has chosen to organize its health care sector is higher administrative costs. And of course, the answer to high administrative costs often seems to be hiring another set of administrators to oversee utilization, promulgate rules for provision of care, double-check payments, and so on.

In many cases, decisions about what medical care to receive and how to deliver that care fall into a gray area. It's often not 100% clear whether a certain procedure was needed, or not needed; not 100% clear that an error was made, or whether a reasonable judgment call was made; or whether a certain administrative act is wasteful, or whether it is reasonable oversight that reduces the risk of poor care and holds down costs. But the report makes a persuasive case that a substantial share of health care spending, not just in the US but in all advanced economies, is not doing much to improve health.

Wednesday, February 22, 2017

Agriculture in Sub-Saharan Africa

Agriculture in countries across sub-Saharan Africa is a large share of GDP, but a much larger share of jobs for many of the poorest people, in an economic context of widespread malnutrition. The OECD‑FAO Agricultural Outlook 2016‑2025 devotes a chapter to "Agriculture in Sub-Saharan Africa: Prospects and challenges for the next decade." Here are some basic facts:

The enormous population boom coming in sub-Saharan Africa in the next several decades is one of those unseen demographic earthquakes that is going to shake up the world economy in all kinds of ways. For example, there will be enormous economic pressures for migration to the relatively nearby countries of the European Union. The evolution of Africa's agriculture sector will play a major role in shaping the characteristics and consequences of its population boom.

"The Sub-Saharan Africa (SSA) region accounts for more than 950 million people, approximately 13% of the global population. By 2050, this share is projected to increase to almost 22% or 2.1 billion. Undernourishment has been a long-standing challenge, with uneven progress across the region. Despite being reduced from 33% in 1990-92 to 23% in 2014-16, the percentage of undernourishment remains the highest among developing regions. Owing to rapid population growth of 2.7% p.a. over the same period, the absolute number of undernourished people has increased by 44 million to reach 218 million. ...

"The high contribution of the agricultural sector to GDP also underlines the limited diversification of most African economies. On average, agriculture contributes 15% of total GDP, however it ranges from below 3% in Botswana and South Africa to more than 50% in Chad ... Agriculture employs more than half of the total labour force and within the rural population, provides a livelihood for multitudes of small-scale producers. Smallholder farms constitute approximately 80% of all farms in SSA and employ about 175 million people directly. ... [R]ecent surveys suggest that agriculture is also the primary source of livelihood for 10% to 25% of urban households."

Economic development typically involves a process of rising productivity in agriculture, along with a shift to producing not just commodity products, but products with higher value-added. How might that process be encouraged and facilitated across sub-Saharan Africa? The report has lots of detail on specifics of cereals, pulses, fruits, livestock, dairy, fish, and so on. Here are some of the broader insights:

Output of agriculture in sub-Saharan Africa has more than doubled in the last 25 years.

However, "[p]roduction growth in SSA has failed to keep pace with demand deriving from population and income growth, resulting in rising imports for food commodities such as wheat, rice and poultry. In many instances, import tariffs have been employed to support domestic producers, particularly relative to other producers outside the region."

In the past, output growth in African agriculture has tended to be driven by more land and more intense cropping, not by improvements in productivity or mechanisation.

What are some of the main priorities that could help African agriculture to evolve in the direction of higher productivity and higher value-added?Output of agriculture in sub-Saharan Africa has more than doubled in the last 25 years.

However, "[p]roduction growth in SSA has failed to keep pace with demand deriving from population and income growth, resulting in rising imports for food commodities such as wheat, rice and poultry. In many instances, import tariffs have been employed to support domestic producers, particularly relative to other producers outside the region."

"The African model of agricultural growth differed significantly from that of Asia or South America. In Asia, growth was driven largely by intensification, whereas in South America, it was the result of significant improvement in labour productivity arising from mechanisation. By contrast, strong growth in SSA agricultural output has accrued predominantly from area expansion and intensification of cropping systems, as opposed to large-scale improvement in productivity. ,,, [P]roductivity per agricultural worker has improved by a factor of only 1.6 in Africa over the past 30 years, compared to 2.5 in Asia."However, future major expansions in agricultural land seem unlikely. "Much of the underutilised land is concentrated in relatively few countries and between one half and two thirds of surplus land is currently under forest cover. Conversion of such forest land to agriculture would come at considerable environmental cost." Thus, the projections for the next decade show only modest rise in agricultural land. More intensive cropping on that land has natural limits, too.

"[A]n important uncertainty that will have a far ranging impact on production practices and productivity growth is the extent of concentration of agricultural land, which in turn will also be influenced by land tenure policies. Increasing concentration and commercialisation of medium-scale farmers could accelerate the rate of technology adoption, which has been fairly slow to date. Efficiency gains by a growing number of small, medium and large-scale farms linked into vertically integrated value chain with greater opportunity for access to credit, technology, extension services and off-take agreements, could have a meaningful impact on output levels in the coming decade. Commensurate development of upstream and downstream food sectors could increase the opportunities for non-farm income, which may in turn provide relatively productive small-scale producers with the capital to break through the barriers of subsistence agriculture into more commercialised medium-scale stature. ...

"Arguably the greatest challenge facing the agricultural sector in SSA is weak infrastructure including transportation networks, access to energy, irrigation systems and stockholding facilities. Poor transportation networks limit access to markets, often exacerbate high levels of post-harvest losses and also inhibit efficient distribution of inputs such as seed and fertiliser. At the same time, it is an underlying factor in high food prices, as it raises the cost of both inputs and imported food products. Substantial differences in price levels between surplus and deficit regions suggest that investments able to reduce the cost of transportation would hold significant benefits to producers and consumers alike."This chapter mentions issues like investing in agricultural research and development as well, but the main priorities emphasized are these issues of infrastructure, property rights, and production chains.

The enormous population boom coming in sub-Saharan Africa in the next several decades is one of those unseen demographic earthquakes that is going to shake up the world economy in all kinds of ways. For example, there will be enormous economic pressures for migration to the relatively nearby countries of the European Union. The evolution of Africa's agriculture sector will play a major role in shaping the characteristics and consequences of its population boom.

Tuesday, February 21, 2017

Why All Exchange Rates Are Bad

The economics of exchange rates can be tough sledding. Every now and then, I post on the bulletin board beside my office a quotation from Kenneth Kasa back in 1995: "If you asked a random sample of economists to name the three most difficult questions confronting mankind, the answers would probably be: (1) What is the meaning of life? (2) What is the relationship between quantum mechanics and general relativity? and (3) What's going on in the foreign exchange market. (Not necessarily in that order)."

But even after duly acknowledging that exchange rates can be a tough subject, the political discussion of how exchange rates are manipulated and unfair to the US economy is a dog's breakfast of confusions about facts, institutions, and economics. For one of many possible examples, see the op-ed published in the Wall Street Journal last week by Judy Shelton, an economist identified as an adviser to the Trump transition team, titled "Currency Manipulation is a Real Problem." The obvious conclusion to draw from that essay, and from a number of other writing on manipulated exchange rates, is that all exchange rates are bad.

Sometimes other countries have policies that the value of their currency is lower relative to that of the US dollar. This is bad, because it benefits exporters from those countries and helps them to sell against US companies in world markets.

But other times, countries are manipulating the value of the exchange rate so that the value of their currency is higher relative to the US dollar, like China. This is also bad, as Shelton write in the WSJ: "Whether China is propping up exchange rates or holding them down, manipulation is manipulation and should not be overlooked. ... A country that props up the value of its currency against the dollar may have strategic goals for investing in U.S. assets."

Exchanges rates that move are bad, too. Shelton writes that "free trade should be based on stable exchange rates so that goods and capital flow in accordance with free-market principles."

But stable exchange rates are also bad. After all, China is apparently stabilizing its exchange rate at the "wrong" level, and the argument that exchange rate manipulation is a problem clearly implies that many major exchange rates around the world should be reshuffled to different levels.

The bottom line is clear as mud. Exchange rates are bad if they are higher, or lower, or moving, or stable. The goal is that exchange rates should be manipulated to arrive at some perfect level, and then should just stick at that level without any further manipulation, which would be forbidden. This perspective on exchange rates is so confused as to be incoherent. With the perils of explaining exchange rates in mind, let me lay out some alternative facts and perspectives.

Currencies are traded in international markets; indeed, about $5 trillion per day is traded on foreign exchange markets. This amount is vastly more than what is needed for international trade of goods and services (about $24 trillion per year) or for foreign direct investment (which is about $1.0-1.5 trillion per year). Thus, exchange rate markets are driven by investors trying to figure out where higher rates of return will be available in the future, while simultanously trying to reduce and diversify the risks they face if exchange rates shift in a way they didn't expect. Because of these dynamics, exchange rate markets are notoriously volatile. For example, they often react quickly and sharply when new information arises about the possibilities of changes in national-level interest rates, inflation rates, and growth rates.

In this context, deciding whether exchange rates have bubbled too high or too low is a tricky business. But William R. Cline regularly puts out a set of estimates. For example, he writes in "Estimates of Fundamental Equilibrium Exchange Rates, November 2016" (Peterson Institute for International Economics, Policy Brief 16-22):

Countries around the world have sought different ways to grapple with risks of exchange rate fluctuations. Small- and medium-sized economies around the world are vulnerable to a nasty cycle in which they first become a popular destination for investors around the world, who hasten to buy their currency (thus driving up its value), as well as investing in their national stock and real estate markets (driving up their prices), and also lending money. But when the news shifts and some other destination becomes the flavor-of-the-month as an investment destination, then as investors sell off the currency and their investments in the country, the exchange rate, stock market, and real estate can all crash. This situation can become even worse if the country has done a lot of borrowing in US dollars, because when the exchange rate falls, it becomes impossible to repay those US-dollar loans. The combination of falling stock market and real estate prices, together with a wave of bad loans, can lead to severe distress in the country's financial sector and steep recession. For details, check with Argentina, Mexico, Thailand, Indonesia, Russia, and a number of others.

The International Monetary Fund puts out regular reports describing exchange rate arrangements, like the Annual Report on Exchange Arrangements and Exchange Restrictions 2014. That report points out that about one-third of the countries in the world have floating exchange rates--that is, rates that are mostly or entirely determined by those $5 trillion per day exchange rate markets. About one-eighth of the countries in the world have "hard peg" exchange rate, in which the country either doesn't have its own separate currency (like the countries sharing the euro) or else the countries technically have a separate currency but manage it so that the exchange rate is always identical (a "currency board" arrangement).

The rest of the economies in the world have some form of "soft peg" or "managed" exchange rate policy. These countries don't dare to leave themselves open to the full force and fluctuations of the international exchange rate markets. But on the other hand, they also don't dare lock in a stable exchange rate in a way that can't change, no matter the cross-national patterns of interest rates, inflation rates, and growth rates. Many of these countries are quite aware that the ultra-stable exchange rate known as the euro has not, to put it mildly, been an unmixed blessing for the countries of Europe.

The fundamental issue is that an exchange rate is a price, the price of one currency in terms of another currency. A weaker currency tends to favor exporters, because their production costs in the domestic currency are lower compared to the revenue they gain when selling in a foreign currency.

A stronger currency tends to favor importers, because they can afford to buy more goods in the supermarket that is the world economy.

Of course, the reality is that the US economy has all kinds of different players, some of whom would benefit from a stronger exchange rate and some of whom would benefit from a weaker exchange rate. Think about the difference between a firm that imports inputs, uses them in production, and re-exports much of the output, as opposed to a form that imports goods that are sold directly to US consumers. Think about the difference between a worker in a firm that does almost no exporting, but benefits as a consumer from stronger exchange rates, and a worker in a firm that does most of its production in the US and then exports heavily, where the employer would benefit from a weaker exchange rate. Think about a firm which has invested heavily in foreign assets: a weaker US dollar makes those foreign assets worth relatively more in US dollar terms, thus rewarding the firm for its foresight in investing abroad.

Here's one useful way to cut through the confusions about what a higher or lower exchange rate means, which is from work done by economists Gita Gopinath, Emmanuel Farhi, Oleg Itskhoki, who point out that the economic effects of changes in exchange rates are fundamentally the same as a policy that combines changes in value-added and payroll taxes. Specifically, a weaker currency has the same effect as a policy of a policy of raising value-added taxes and cutting payroll taxes by an equivalent amount. This should make some intuitive sense, because a weaker currency makes it harder for buyers (like a higher value-added tax) but reduces the relative costs of domestic production (like a lower payroll tax).

In short, every time the US exchange rate moves, for whatever reason, there will be a mixed bag of those who benefit and those who are harmed. A weaker currency is the economic equivalent of combining a higher tax that hinders consumption, like the higher value-added (or sales) tax, with an offsetting cut in a tax that lowers costs of domestic production, like the lower payroll tax. If the policy goal is to help US exporters, but not to impose costs on US importers and consumers, then seeking a lower US dollar exchange rate is the wrong policy tool. It is a mirage (and a fundamental confusion) to argue that some change in the dollar exchange rate will be all benefits and no costs for the US economy.

Just to be clear, I'm certainly not arguing that exchange rates are never "too high" or "too low"; it's clear that exchange rates are volatile and can have bubbles and valleys.

Nor am I arguing that countries never try to manipulate their exchange rates; indeed, I would argue that every country manipulates its exchange rates in one way or another. If countries allow their exchange rates to float, then when the central bank adjusts interest rates or allows a chance in inflation or stimulates an economy, the exchange rate is going to shift, which is clearly a way in which exchange rates are manipulated by policy. If countries don't let their exchange rates move, that's clearly a form of manipulation. And if countries allow their exchange rates to move, but act to limit big swings in those movements, that is also manipulation.

What I am arguing is that given even a basic notion how exchange rate markets work and the economic forces that affect exchange rates, it is opaque how "non-manipulation" would work. Are exchange rates going to be held stable across countries, even in the face of cross-national economic changes in interest rates, inflation, and growth? A wide variety of experience, including the breakdown of the Bretton Woods agreement in the early 1970s and the current problems with euro, suggest that holding exchange rates stable is impractical over time and can have some very bad consequences. But if exchange rates are going to be allowed to move, then the question arises of who decides when and how much. Most national governments, especially after having watched the euro in action, will want to keep some power over exchange rates. There are serious people who discuss what kind of international agreements and cooperation it would take to have greater exchange rate stability, but it's a hard task, and squawking about how all exchange rates are bad--stronger, weaker, moving, stable--is not a serious answer.

But even after duly acknowledging that exchange rates can be a tough subject, the political discussion of how exchange rates are manipulated and unfair to the US economy is a dog's breakfast of confusions about facts, institutions, and economics. For one of many possible examples, see the op-ed published in the Wall Street Journal last week by Judy Shelton, an economist identified as an adviser to the Trump transition team, titled "Currency Manipulation is a Real Problem." The obvious conclusion to draw from that essay, and from a number of other writing on manipulated exchange rates, is that all exchange rates are bad.

Sometimes other countries have policies that the value of their currency is lower relative to that of the US dollar. This is bad, because it benefits exporters from those countries and helps them to sell against US companies in world markets.

But other times, countries are manipulating the value of the exchange rate so that the value of their currency is higher relative to the US dollar, like China. This is also bad, as Shelton write in the WSJ: "Whether China is propping up exchange rates or holding them down, manipulation is manipulation and should not be overlooked. ... A country that props up the value of its currency against the dollar may have strategic goals for investing in U.S. assets."

Exchanges rates that move are bad, too. Shelton writes that "free trade should be based on stable exchange rates so that goods and capital flow in accordance with free-market principles."

But stable exchange rates are also bad. After all, China is apparently stabilizing its exchange rate at the "wrong" level, and the argument that exchange rate manipulation is a problem clearly implies that many major exchange rates around the world should be reshuffled to different levels.

The bottom line is clear as mud. Exchange rates are bad if they are higher, or lower, or moving, or stable. The goal is that exchange rates should be manipulated to arrive at some perfect level, and then should just stick at that level without any further manipulation, which would be forbidden. This perspective on exchange rates is so confused as to be incoherent. With the perils of explaining exchange rates in mind, let me lay out some alternative facts and perspectives.

Currencies are traded in international markets; indeed, about $5 trillion per day is traded on foreign exchange markets. This amount is vastly more than what is needed for international trade of goods and services (about $24 trillion per year) or for foreign direct investment (which is about $1.0-1.5 trillion per year). Thus, exchange rate markets are driven by investors trying to figure out where higher rates of return will be available in the future, while simultanously trying to reduce and diversify the risks they face if exchange rates shift in a way they didn't expect. Because of these dynamics, exchange rate markets are notoriously volatile. For example, they often react quickly and sharply when new information arises about the possibilities of changes in national-level interest rates, inflation rates, and growth rates.

In this context, deciding whether exchange rates have bubbled too high or too low is a tricky business. But William R. Cline regularly puts out a set of estimates. For example, he writes in "Estimates of Fundamental Equilibrium Exchange Rates, November 2016" (Peterson Institute for International Economics, Policy Brief 16-22):

"As of mid-November, the US dollar has become overvalued by about 11 percent. The prospect of fiscal stimulus and associated interest rate increases under the new US administration risks still further increases in the dollar. The new estimates, all based on October exchange rates, again find a modest undervaluation of the yen (by 3 percent) but no misalignment of the euro and Chinese renminbi. The Korean won is undervalued by 6 percent. Cases of significant overvaluation besides that of the United States include Argentina (by about 7 percent), Turkey (by about 9 percent), Australia (by about 6 percent), and New Zealand (by about 4 percent). A familiar list of smaller economies with significantly undervalued currencies once again shows undervaluation in Singapore and Taiwan (by 26 to 27 percent), and Sweden and Switzerland (by 5 to 7 percent)."Several points are worth emphasizing here. The exchange rates of the euro, China's renminbi, and Japan's yen don't appear much overvalued. The US dollar does seem overvalued, but the underlying economic reasons aren't mainly about manipulation by other countries. Instead, it's because investor in the turbulent foreign exchange markets are looking ahead at promises from the Trump administration that would lead to large fiscal stimulus and predictions from the Federal Reserve of higher exchange rates, and demanding more US dollars as a result.

Countries around the world have sought different ways to grapple with risks of exchange rate fluctuations. Small- and medium-sized economies around the world are vulnerable to a nasty cycle in which they first become a popular destination for investors around the world, who hasten to buy their currency (thus driving up its value), as well as investing in their national stock and real estate markets (driving up their prices), and also lending money. But when the news shifts and some other destination becomes the flavor-of-the-month as an investment destination, then as investors sell off the currency and their investments in the country, the exchange rate, stock market, and real estate can all crash. This situation can become even worse if the country has done a lot of borrowing in US dollars, because when the exchange rate falls, it becomes impossible to repay those US-dollar loans. The combination of falling stock market and real estate prices, together with a wave of bad loans, can lead to severe distress in the country's financial sector and steep recession. For details, check with Argentina, Mexico, Thailand, Indonesia, Russia, and a number of others.

The International Monetary Fund puts out regular reports describing exchange rate arrangements, like the Annual Report on Exchange Arrangements and Exchange Restrictions 2014. That report points out that about one-third of the countries in the world have floating exchange rates--that is, rates that are mostly or entirely determined by those $5 trillion per day exchange rate markets. About one-eighth of the countries in the world have "hard peg" exchange rate, in which the country either doesn't have its own separate currency (like the countries sharing the euro) or else the countries technically have a separate currency but manage it so that the exchange rate is always identical (a "currency board" arrangement).

The rest of the economies in the world have some form of "soft peg" or "managed" exchange rate policy. These countries don't dare to leave themselves open to the full force and fluctuations of the international exchange rate markets. But on the other hand, they also don't dare lock in a stable exchange rate in a way that can't change, no matter the cross-national patterns of interest rates, inflation rates, and growth rates. Many of these countries are quite aware that the ultra-stable exchange rate known as the euro has not, to put it mildly, been an unmixed blessing for the countries of Europe.

The fundamental issue is that an exchange rate is a price, the price of one currency in terms of another currency. A weaker currency tends to favor exporters, because their production costs in the domestic currency are lower compared to the revenue they gain when selling in a foreign currency.

A stronger currency tends to favor importers, because they can afford to buy more goods in the supermarket that is the world economy.

Of course, the reality is that the US economy has all kinds of different players, some of whom would benefit from a stronger exchange rate and some of whom would benefit from a weaker exchange rate. Think about the difference between a firm that imports inputs, uses them in production, and re-exports much of the output, as opposed to a form that imports goods that are sold directly to US consumers. Think about the difference between a worker in a firm that does almost no exporting, but benefits as a consumer from stronger exchange rates, and a worker in a firm that does most of its production in the US and then exports heavily, where the employer would benefit from a weaker exchange rate. Think about a firm which has invested heavily in foreign assets: a weaker US dollar makes those foreign assets worth relatively more in US dollar terms, thus rewarding the firm for its foresight in investing abroad.

Here's one useful way to cut through the confusions about what a higher or lower exchange rate means, which is from work done by economists Gita Gopinath, Emmanuel Farhi, Oleg Itskhoki, who point out that the economic effects of changes in exchange rates are fundamentally the same as a policy that combines changes in value-added and payroll taxes. Specifically, a weaker currency has the same effect as a policy of a policy of raising value-added taxes and cutting payroll taxes by an equivalent amount. This should make some intuitive sense, because a weaker currency makes it harder for buyers (like a higher value-added tax) but reduces the relative costs of domestic production (like a lower payroll tax).

In short, every time the US exchange rate moves, for whatever reason, there will be a mixed bag of those who benefit and those who are harmed. A weaker currency is the economic equivalent of combining a higher tax that hinders consumption, like the higher value-added (or sales) tax, with an offsetting cut in a tax that lowers costs of domestic production, like the lower payroll tax. If the policy goal is to help US exporters, but not to impose costs on US importers and consumers, then seeking a lower US dollar exchange rate is the wrong policy tool. It is a mirage (and a fundamental confusion) to argue that some change in the dollar exchange rate will be all benefits and no costs for the US economy.

Just to be clear, I'm certainly not arguing that exchange rates are never "too high" or "too low"; it's clear that exchange rates are volatile and can have bubbles and valleys.

Nor am I arguing that countries never try to manipulate their exchange rates; indeed, I would argue that every country manipulates its exchange rates in one way or another. If countries allow their exchange rates to float, then when the central bank adjusts interest rates or allows a chance in inflation or stimulates an economy, the exchange rate is going to shift, which is clearly a way in which exchange rates are manipulated by policy. If countries don't let their exchange rates move, that's clearly a form of manipulation. And if countries allow their exchange rates to move, but act to limit big swings in those movements, that is also manipulation.

What I am arguing is that given even a basic notion how exchange rate markets work and the economic forces that affect exchange rates, it is opaque how "non-manipulation" would work. Are exchange rates going to be held stable across countries, even in the face of cross-national economic changes in interest rates, inflation, and growth? A wide variety of experience, including the breakdown of the Bretton Woods agreement in the early 1970s and the current problems with euro, suggest that holding exchange rates stable is impractical over time and can have some very bad consequences. But if exchange rates are going to be allowed to move, then the question arises of who decides when and how much. Most national governments, especially after having watched the euro in action, will want to keep some power over exchange rates. There are serious people who discuss what kind of international agreements and cooperation it would take to have greater exchange rate stability, but it's a hard task, and squawking about how all exchange rates are bad--stronger, weaker, moving, stable--is not a serious answer.

Friday, February 17, 2017

Declining US Investment, Gross and Net

In any given year, a sizable chunk of investment goes to replacing what wore out or became obsolete in the previous year. Thus, the Bureau of Economic Analysis calculates both gross investment, which is the total invested, and net investment, which is what is actually added to the capital stock after accounting for investment that only offset the depreciation of the older capital. Both gross and net investment by private business have been declining in the US economy--but net investment is declining faster. Consider some a couple of figures.

This blue line on the graph shows gross investment by private domestic firms, while the red line shows net investment by private firms, both divided by GDP. You can see that from the 1970s and up into the 1990s, high levels of gross investment exceeded 14% of GDP. But since 2000, high levels of gross investment don't reach 14% of GDP. Interestingly, the drop-off in investment seems more visible in the red line showing net investment.

In the next figure, net domestic investment by private domestic firms is divided by gross investment: in effect, this calculation shows what percentage of total investment is actually adding to the capital stock, rather than just replacing earlier investments that have depreciated. The striking pattern is that from the 1960s up to the early 1980s, it was common for about 40% or more of total investment to be "net" or new investment. But since about 2000, it's been common for about 20% of total investment to be "net" or new investment, while the other 80% is replacing older capital stock.

The decline in net investment also shows up in government infrastructure investment, especially in the years since the Great Recession. Here's a figure from "If You Build It: A Guide to the Economicsof Infrastructure Investment," a useful overview of issues related to infrastructure spending by Diane Whitmore Schanzenbach, Ryan Nunn, and Greg Nantz (Hamilton Project, February 2017).

I haven't done a deep enough dive into the underlying methodologies here to see why the net/gross ratio for private investment is falling so sharply, or if some of these reasons may help to to explain the fall in net infrastructure investment. I have seen some discussion that part of the reason is that capital investment is more likely to be in the form of computers and software, which become outdated more quickly (given technological progress in this area) than, say, large machine purchased for industrial production in old-style plants. But there are other possible explanations. (If someone out there has dug down into the growing gap between gross and net investment and how it manifests itself in the Bureau of Economic Analysis statistics, please send me the paper or a link. I'd be happy to learn more.)

The decline in investment is bothersome in a number of ways. Investment in physical capital is one of the factors that over time raises productivity and wages. It's a little troublesome that 80% of gross investment is going to replace old capital, rather than add to the capital stock. And low investment is at the root of concerns about the possibility of "secular stagnation," which is a worry that the economy is headed for a slow-growth future because investment spending is likely to remain low.

This blue line on the graph shows gross investment by private domestic firms, while the red line shows net investment by private firms, both divided by GDP. You can see that from the 1970s and up into the 1990s, high levels of gross investment exceeded 14% of GDP. But since 2000, high levels of gross investment don't reach 14% of GDP. Interestingly, the drop-off in investment seems more visible in the red line showing net investment.

In the next figure, net domestic investment by private domestic firms is divided by gross investment: in effect, this calculation shows what percentage of total investment is actually adding to the capital stock, rather than just replacing earlier investments that have depreciated. The striking pattern is that from the 1960s up to the early 1980s, it was common for about 40% or more of total investment to be "net" or new investment. But since about 2000, it's been common for about 20% of total investment to be "net" or new investment, while the other 80% is replacing older capital stock.

The decline in net investment also shows up in government infrastructure investment, especially in the years since the Great Recession. Here's a figure from "If You Build It: A Guide to the Economicsof Infrastructure Investment," a useful overview of issues related to infrastructure spending by Diane Whitmore Schanzenbach, Ryan Nunn, and Greg Nantz (Hamilton Project, February 2017).

I haven't done a deep enough dive into the underlying methodologies here to see why the net/gross ratio for private investment is falling so sharply, or if some of these reasons may help to to explain the fall in net infrastructure investment. I have seen some discussion that part of the reason is that capital investment is more likely to be in the form of computers and software, which become outdated more quickly (given technological progress in this area) than, say, large machine purchased for industrial production in old-style plants. But there are other possible explanations. (If someone out there has dug down into the growing gap between gross and net investment and how it manifests itself in the Bureau of Economic Analysis statistics, please send me the paper or a link. I'd be happy to learn more.)

The decline in investment is bothersome in a number of ways. Investment in physical capital is one of the factors that over time raises productivity and wages. It's a little troublesome that 80% of gross investment is going to replace old capital, rather than add to the capital stock. And low investment is at the root of concerns about the possibility of "secular stagnation," which is a worry that the economy is headed for a slow-growth future because investment spending is likely to remain low.

Thursday, February 16, 2017

The Economic Vision for Precocious, Cleavaged India

India has more than 1.2 billion people, and it is has been growing rapidly and carrying out substantial policy changes, but it seems to get only a small fraction of the attention paid to China. For those looking to get up to speed on India's economy, a useful starting point is the Economic Survey 2016-2017, published in January 2017 by India's Ministry of Finance (where Arvind Subramanian is the Chief Economic Adviser). The page also has a drop-down menu with links to previous annual surveys.

The title of this post is taken from the title of Chapter 2 of the report. "Precocious" refers to the facgt that India has been a democracy for so long, and that it turned to democracy started when the country was at such low level of per capita GDP. The term "cleavaged" refers to separations in India. As the report notes: At the same time, India was also a highly cleavaged society. Historians have

remarked how it has many more axes of cleavage than other countries: language and scripts, religion, region, caste, gender, and class ..." Here are seven points from the report that stuck with me.

1) In recent years, India's rate of economic growth is faster than China, and India has not been taking on the extraordinary debt load of China.

The left-hand panel shows GDP growth (blue line) and debt/GDP level (red line) for China. The right-hand panel shows the same patterns for India.

2) India has become quite open to foreign trade,but also to internal trade across regions of India.

For example, here's a figure comparing China and India on trade as a share of GDP.

And here's a figure showing where the horizontal axis shows the size of a country's population (measured in logs) and the vertical axis shows trade/GDP. Countries with more people tend to have relatively more internal trade, and thus their ratio of external trade/GDP is lower. China and India are both out at the far right as large-population countries. Both are above the best-fit line, which means that their level of external trade is higher than the usual pattern, given their population levels.

When it comes to India's internal market, and flows across state borders, the report notes:

The left-hand panel shows capital flows as a share of GDP over five years, in which India is pretty similar to Indonesia, Mexico, and China. The right-hand panel shows patterns just for India of inflow of foreign direct investment, which have been rising as a share of GDP.

4) In many Indians states, wages for semi-skilled workers are low by world standards.

The report discusses the possibility that India could latch on to a substantial share of low-wage manufacturing in areas like apparel and shoes.

5) India has has more success than many low-income countries in participating in international trade in services, but with the tides seemingly running against globalization, there is some question about whether this will continue.

Here's a figure showing per capita GDP, with each row showing a state of India. The red squares show the levels in 1984; the blue circles, in 1994; the green triangles, 2004; the yellow diamonds, 2014. The spread across regions is clearly widening. The figure reminds me of an old line about the economy of India, describing it as "part southern California, part sub-Saharan Africa."

There are several layers of puzzle here, as the report notes:

The green bars show production from state-owned enterprises in India--known there as "public sector undertakings" or PSUs--as measured by share of sales, profits, assets, and market value. The red bars show the same measures for China; yellow bars, Russia; dark blue bars, Brazil; gray bars, Indonesia; light blue bars, South Africa; purple bars, Malaysia. All of these countries show what would be a large level of state-owned enterprises by the standards of high-income countries, but India does not especially stand out. .

However, India does stand out in how its citizens feel about the private sector. This graph shows the results from a group of questions about the private sector on the World Values Survey. The level of pro-market sentiment in India is comparable to Argentina and Russia.

There is much more in the report. For example, a number of chapters are focused on specific policy changes and proposals. One chapter discusses the "demonetisation," in which India recently took its two largest-denomination notes out of circulation, abruptly and without warning, as a way of fighting corruption, crime, and the underground economy. Another chapter discusses the possibility of a large public agency to take on the legacy of bad debt, and clear the balance sheets for large companies and banks, so that they can focus on looking ahead rather than on cleaning up past problems. Yet another chapter discusses the idea of a universal basic income in India. "The central government alone runs about 950 central sector and centrally sponsored sub-schemes which cost about 5 percent of GDP." But these programs impose considerable bureaucratic cost and fail to assist many of the actually poor.

Homage: I ran across a mention of this report in a post by Alex Tabarrok at the always-interesting Marginal Revolution website, which focuses on a chapter of the report discussing how a number of India's governmental redistribution programs are ineffective and even counterproductive.

The title of this post is taken from the title of Chapter 2 of the report. "Precocious" refers to the facgt that India has been a democracy for so long, and that it turned to democracy started when the country was at such low level of per capita GDP. The term "cleavaged" refers to separations in India. As the report notes: At the same time, India was also a highly cleavaged society. Historians have

remarked how it has many more axes of cleavage than other countries: language and scripts, religion, region, caste, gender, and class ..." Here are seven points from the report that stuck with me.

1) In recent years, India's rate of economic growth is faster than China, and India has not been taking on the extraordinary debt load of China.

The left-hand panel shows GDP growth (blue line) and debt/GDP level (red line) for China. The right-hand panel shows the same patterns for India.

2) India has become quite open to foreign trade,but also to internal trade across regions of India.

For example, here's a figure comparing China and India on trade as a share of GDP.

And here's a figure showing where the horizontal axis shows the size of a country's population (measured in logs) and the vertical axis shows trade/GDP. Countries with more people tend to have relatively more internal trade, and thus their ratio of external trade/GDP is lower. China and India are both out at the far right as large-population countries. Both are above the best-fit line, which means that their level of external trade is higher than the usual pattern, given their population levels.

When it comes to India's internal market, and flows across state borders, the report notes:

India’s aggregate interstate trade (54 per cent of GDP) is not as high as that of the United States (78 per cent of GDP) or China (74 per cent of GDP) but substantially greater than provincial trade within Canada and greater than trade between Europe Union (EU) countries (which is governed by the “four freedoms”: allowing unfettered movement of goods, services, capital, and people). This is all the more striking given that the data here covers mainly manufactured goods, excludes agricultural products, and is therefore an underestimate of total internal trade in goods. A substantial portion (almost half) of trade across states in India occurs as stock transfers within firms. That is, intrafirm trade is high relative to arms-length trade ...3) India has become fairly open to inflows of foreign capital.

The left-hand panel shows capital flows as a share of GDP over five years, in which India is pretty similar to Indonesia, Mexico, and China. The right-hand panel shows patterns just for India of inflow of foreign direct investment, which have been rising as a share of GDP.

4) In many Indians states, wages for semi-skilled workers are low by world standards.

The report discusses the possibility that India could latch on to a substantial share of low-wage manufacturing in areas like apparel and shoes.

5) India has has more success than many low-income countries in participating in international trade in services, but with the tides seemingly running against globalization, there is some question about whether this will continue.

"If India grows rapidly on the back of dynamic services exports, the world’s service exports-GDP ratio will increase by 0.5 percentage points—which would be a considerable proportion of global exports. Put differently, India’s services exports growth will test the world’s globalisation carrying capacity in services. Responses could take not just the form of restrictions on labor mobility but also restrictions in advanced countries on outsourcing.

"It is possible that the world’s carrying capacity will actually be much greater for India’s services than it was for China’s goods. After all, China’s export expansion over the past two decades was imbalanced in several ways: the country exported far more than it imported; it exported manufactured goods to advanced countries, displacing production there, but imported goods (raw materials) from developing countries; and when it did import from advanced economies, it often imported services rather than goods. As a result, China’s development created relatively few export-oriented jobs in advanced countries, insufficient to compensate for the jobs lost in manufacturing – and where it did create jobs, these were in advanced services (such as finance), which were not possible for displaced manufacturing workers to obtain.

"In contrast, India’s expansion may well prove much more balanced. India has tended to run a current account deficit, rather than a surplus; and while its service exports might also displace workers in advanced countries, their skill set will make relocation to other service activities easier; indeed, they may well simply move on to complementary tasks, such as more advanced computer programming in the IT sector itself. On the other hand, since skilled labour in advanced economies will be exposed to Indian competition, their ability to mobilize political opinion might also be greater."6) India is experiencing a sharp divergence and widening gaps in income and consumption across the states of India.

Here's a figure showing per capita GDP, with each row showing a state of India. The red squares show the levels in 1984; the blue circles, in 1994; the green triangles, 2004; the yellow diamonds, 2014. The spread across regions is clearly widening. The figure reminds me of an old line about the economy of India, describing it as "part southern California, part sub-Saharan Africa."

There are several layers of puzzle here, as the report notes:

"Poorer countries are catching up with richer countries, the poorer Chinese provinces are catching up with the richer ones, but in India, the less developed states are not catching up; instead they are, on average, falling behind the richer states. ... This trend is particularly puzzling since that the forces of equalization—trade in goods and movement of people—are stronger within India than they are across countries, and they are getting stronger over time. This raises the possibility that governance traps are impeding equalization within India. ...