This falling labor share is not some statistic recently created and promoted by partisan sources. It's calculated by the US Bureau of Labor Statistics, using a methodology that has remained more-or-less standard over the years. Two economists at the BLS, Michael D. Giandrea and Shawn A. Sprague, explain "Estimating the Labor Share" along with an overview of research findings on the issue in the February 2017 issue of the Monthly Labor Review.

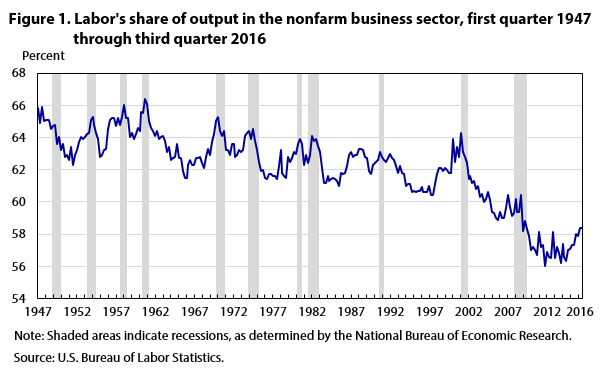

As a starting point, here's their figure showing labor's share:

There seems to be a slow decline in the labor share from the 1960s though the 1990s, which is briefly interrupted by a dot-com bounce at the 1990s, and then turns into a faster decline in the early 2000s. This pattern is part of what lies behind some other much-discussed changes in the US economy. For example, average wage increases have not matched up average productivity gains in recent decades, which is because the share going to labor is declining. A smaller labor share also has implications for the distribution of overall income, because it implies that those who receive a greater share of their income from non-labor sources, like returns on investment, are going to do relatively well.

Giandrea and Sprague offer a nice concise overview of the main hypotheses for explaining the declining labor share. The theories include:

Cheaper investment goods, like computers, are leading firms to use more capital and less labor, which reduced the labor share.

Giandrea and Sprague offer a nice concise overview of the main hypotheses for explaining the declining labor share. The theories include:

Cheaper investment goods, like computers, are leading firms to use more capital and less labor, which reduced the labor share.

For example, the authors write: "Karabarbounis and Neiman examined data from more than 50 countries and argue that the decline in the relative price of investment goods—in particular, computerized capital—has led firms to employ more capital and relatively less labor. They find that this shift has been responsible for approximately one-half of the observed decline in the labor share."

A related version of this theory is that while some new technologies should be viewed as substituting for labor, many other should be viewed as augmenting the productive power of labor. As the authors describe it: "Lawrence writes that increases in labor-augmenting technical changes essentially increase the amount of labor provided by a given number of workers, thereby decreasing labor’s share of output."

The underlying assumptions about "proprietor income" are biasing the labor share calculations.

The calculation of labor share involve adding compensation received by employees to "proprietor income," which is the labor income received by those who run their own business. However, proprietor income is conceptually tough to measure, because someone who owns their own business can receive both "labor income," as if the person was an employee of their own business, and "capital income," as the owner of the business. In the real world, these two types of payments are jumbled together. To address this issue, the Bureau of Labor Statistics has assumed that the hourly labor compensation of proprietors is the same as that of employees. However, if the labor income of proprietors is actually rising over time, then this assumption means that the labor share is understated. One study finds that about one-third of the observed decline in labor share is due to this assumption that the hourly labor compensation of proprietors is the same as that of employees, rather than using an alternative method that tries to estimate the capital income of proprietors directly.

Increased imports of labor-intensive goods.

A rise in imports of more labor-intensive goods means that production in the US economy will tend to be focused on less labor-intensive goods, which should tend to drive down the labor share. Teh authors cite work by Elsby, Hobijn, and Şahin concerning "an increased reliance on imported inputs used in domestic production, especially inputs that have labor-intensive production processes. These `offshored' inputs are typically produced in countries with lower labor costs, resulting in an overall reduction in the price of domestically produced final goods."

Different industries have different labor shares, so shifts in which industries are larger or smaller can affect labor share.

The authors write: "Declines in durable goods manufacturing and nondurable goods manufacturing were responsible for 2.8 percentage points and 1.6 percentage points, respectively, of the decline in the overall labor share. Over the same period, several industries showed gains in their labor share—led by professional and business services, which contributed 2.5 percentage points, partially offsetting the decline in the overall labor share.

These explanations all have some plausibility, but it isn't clear to me that, taken together, they adequately explain the fall of more than four percentage points in labor share in the decade or so from the early 2000s (roughly 61%) to the years right after the Great Recession (just above 56%). The labor share does show some sign of rebounding in the last couple of year, and it will be interesting to see whether that turns out to be true bounce-back or a damp squib.