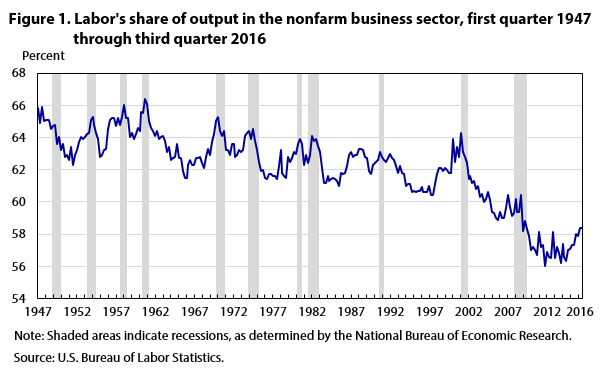

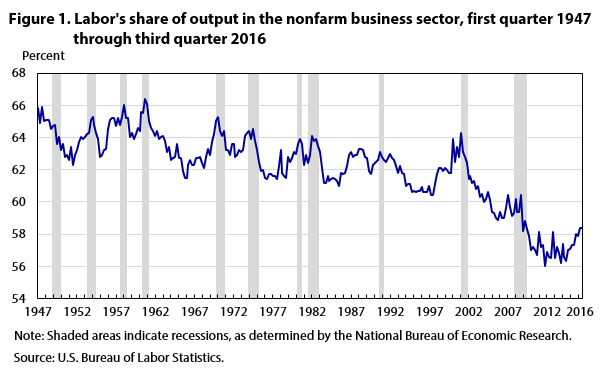

However, the US Bureau of Labor Statistics has been doing this calculation for decades using a standardized methodology over time. The US labor share of income was in the range of 61-65% from the 1950s up through the 1990s. Indeed, for purposes of basic long-run economic models, the share was sometimes treated as a constant. But in the early 2000s, the labor share started dropping and fell to the historically low range of 56-58%. Loukas Karabarbounis and Brent Neiman provide some perspective on what has happened, citing a lot of the recent research. in "Trends in Factor Shares: Facts and Implications," appearing in the NBER Reporter (2017, Number 4).

They built up a data set for a range of countries, and found that many of them had experienced a decline in labor share. Thus, the underlying economic explanation is unlikely to be a purely US factor, but instead needs to be something that reaches across many economies. They write: "The decline has been broad-based. As shown in Figure 1, it occurred in seven of the eight largest economies of the world. It occurred in all Scandinavian countries, where labor unions have traditionally been strong. It occurred in emerging markets such as China, India, and Mexico that have opened up to international trade and received outsourcing from developed countries such as the United States."

They argue that one major factor behind this shift is cheaper information technology, which encouraged firms to substitute capital for labor. They write:

They built up a data set for a range of countries, and found that many of them had experienced a decline in labor share. Thus, the underlying economic explanation is unlikely to be a purely US factor, but instead needs to be something that reaches across many economies. They write: "The decline has been broad-based. As shown in Figure 1, it occurred in seven of the eight largest economies of the world. It occurred in all Scandinavian countries, where labor unions have traditionally been strong. It occurred in emerging markets such as China, India, and Mexico that have opened up to international trade and received outsourcing from developed countries such as the United States."

They argue that one major factor behind this shift is cheaper information technology, which encouraged firms to substitute capital for labor. They write:

"There was a decline in the price of investment relative to consumption that accelerated globally around the same time that the global labor share began its decline. A key hypothesis that we put forward is that the decline in the relative price of investment, often attributed to advances in information technology, automation, and the computer age, caused a decline in the cost of capital and induced firms to produce with greater capital intensity. If the elasticity of substitution between capital and labor — the percentage change in the capital-labor ratio in response to a percentage change in the relative cost of labor and capital — is greater than one, the lowering of the cost of capital results in a decline in the labor share.... [O]ur estimates imply that this form of technological change accounts for roughly half of the decline in the global labor share. ...The fall in the labor share of income has consequences that ripple through the rest of the global economy. For example, it contributes to the rise in inequality. Another change from a few decades ago is that corporations used to raise money from household savers, by issuing bonds, taking out loans, or selling stock. But with the rise in the capital share and corporate profits, about two-thirds of global investments is financed by firms themselves. Indeed, it used to be that there were net flows of financial capital into the corporate sector; now, there are net flows of financial capital out of the corporate sector (through stock buy-backs, the rise in corporate cash holdings, and other mechanisms). When comparing current stock prices and price-earnings ratios to historical values, it's worth remembering when the capital share of income is higher, stock prices represent a different value proposition than they did several decades ago.

"If technology explains half of the global labor share decline, what might explain the other half? We use investment flows data to separate residual payments into payments to capital and economic profits, and find that the capital share did not rise as it should if capital-labor substitution entirely accounted for the decline in the labor share. Rather, we note that increases in markups and the share of economic profits also played an important role in the labor share decline."

For previous posts on the declining labor share of income, see:

- "The Declining U.S. Labor Share, Explicated" (February 27, 2017)

- "Falling Labor Share: Measurement Issues and Candidate Explanations" (August 28, 2015)

- "Digging into Capital and Labor Income Shares" (March 20, 2015)

- "Breaking Down the Falling Labor Share of US Income" (September 9, 2013)

- "Labor's Falling Share, Everywhere" (June 6, 2013)