There seems to be a widespread sense that many problems of the US economy are linked to a lack of dynamism and competition, and that a surge of antitrust enforcement might be a part of the answer. Here are three somewhat separable questions to ponder in addressing this topic.

1) Is rising concentration a genuine problem in most of the economy, or only in a few niches?

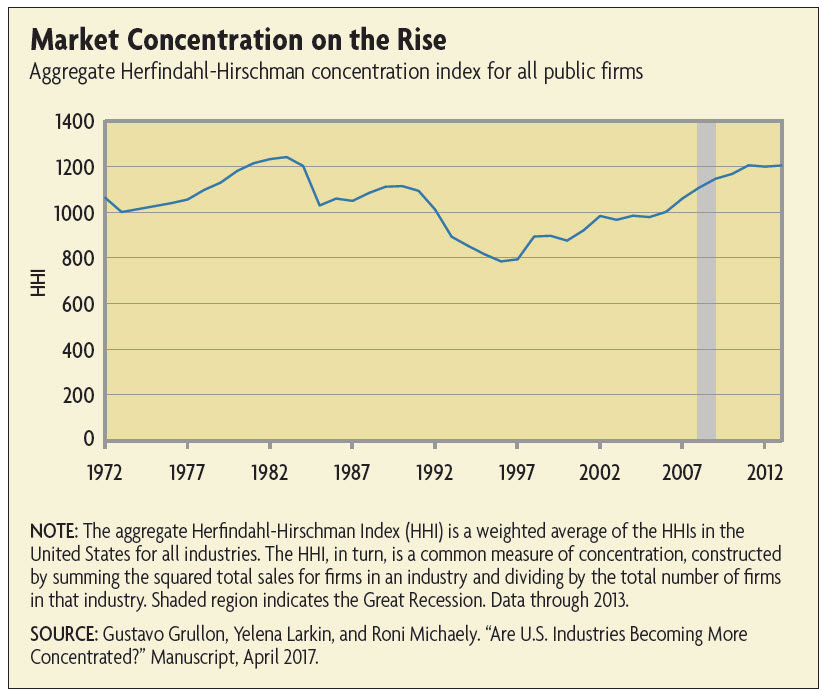

The evidence does suggest that concentration has risen in many industries. However, it also suggests that for most industries the rise in concentration is small, and within recent historical parameters. For example, here's a figure from an article by Tim Sablik, "Are Markets Too Concentrated?" published in Econ Focus, from the Federal Reserve Bank of Richmond (First Quarter 2018, pp. 10-13). The HHI is a standard measure of market concentration: it is calculated by taking the market share of each firm in an industry, squaring it, and then summing the result. Thus, a monopoly with 100% of the market would have a HHI measure of 1002 , or 10,000. A industry with, say, two leading firms that each have 30% of the market and four other firms with 10% of the market would have an HHI of 2200. The average HHI across industries has indeed risen--back to the level that prevailed in the late 1970s and early 1980s.

A couple of other points are worth noting:

In some of the industries where concentration has risen, recent legislation is clearly one of the important underlying causes. For example, healthcare providers and insurance firms became more concentrated in the aftermath of restrictions and rules imposed by the Patient Protection and Affordable Care act of 2010. The US banking sector became more concentrated in the aftermath of

Wall Street Reform and Consumer Protection Act of 2010 (the Dodd-Frank act). In both cases, supporters of the bill saw additional concentration as a useful tool for seeking to achieve the purported benefits of the legislation.

The rise in bigness that seems to bother people the most is the dominance of Apple, Alphabet, Amazon, Facebook, and Microsoft. The possibility that these firms raise anticompetitive issues seems to me like a very legitimate concern. But it also suggests that the competition issues of most concern apply mostly to a relatively small number of firms in a relatively small number of tech-related industries.

2) Is rising concentration the result of pro-competitive, productivity-raising actions that benefit consumers, or anti-competitive actions that hurt consumers?

The general perspective of US antitrust law is that there is no reason to hinder or break up a firm that achieves large size and market domination by providing innovative and low-cost products for consumers. But if a large firm is using its size to hinder competition or to keep prices high, then the antitrust authorities can have reason to step in. So which is it? Sablik writes:

"Several recent studies have attempted to determine whether the current trend of rising concentration is due to the dominance of more efficient firms or a sign of greater market power. The article by Autor, Dorn, Katz, Patterson, and Van Reenen lends support to the Chicago view, finding that the industries that have become more concentrated since the 1980s have also been the most productive. They argue that the economy has become increasingly concentrated in the hands of `superstar firms,' which are more efficient than their rivals."

"The tech sector in particular may be prone to concentration driven by efficiency. Platforms for search or social media, for example, become more valuable the more people use them. A social network, like a phone network, with only two people on it is much less valuable than one with millions of users. These network effects and scale economies naturally incentivize firms to cultivate the biggest platforms — one-stop shops, with the winning firm taking all, or most, of the market. Some economists worry these features may limit the ability of new firms to contest the market share of incumbents. ... Of course, there are exceptions. Numerous online firms that once seemed unstoppable have since ceded their dominant position to competitors. America Online, eBay, and MySpace have given way to Google, Amazon, Facebook, and Twitter."There is also international evidence that leading edge firms in many industries are pulling ahead of others in the industry in terms of productivity growth. Here seems to me reason for concern that well-established firms in industries with these network effects have found a way to establish a position that makes it hard--although clearly not impossible--for new competitors to enter. For example, Federico J. Díez, Daniel Leigh, and Suchanan Tambunlertchai have published "Global Market Power and its Macroeconomic Implications" (IMF Working Paper WP/18/137, June 2018). They write:

"We estimate the evolution of markups of publicly traded firms in 74 economies from 1980-2016. In advanced economies, markups have increased by an average of 39 percent since 1980. The increase is broad-based across industries and countries, and driven by the highest markup firms in each economic sector. ... Focusing on advanced economies, we investigate the relation between markups and investment, innovation, and the labor share at the firm level. We find evidence of a non-monotonic relation, with higher markups being correlated initially with increasing and then with decreasing investment and innovation rates. This non-monotonicity is more pronounced for firms that are closer to the technological frontier. More concentrated industries also feature a more negative relation between markups and investment and innovation."In other words, firms may at first achieve their leadership and higher profits with a burst of innovation, but over time, the higher profits are less associated with investment and innovation.

An interrelated but slightly different argument that what the rise in concentration is telling us is less about the behavior of large firms, and more about a slowdown in the arrival of new firms. For example, it's no surprise that concentration was lower in the 1990s, with the rise of the dot-com companies, and it's no surprise that concentration then rose again after that episode. Jason Furman and Peter Orszag explore these issues in "Slower Productivity and Higher Inequality: Are They Related?" (June 2018, Peterson Institute of International Economics, Working Paper 18-4). They argue that the rise of "superstar" firms has been accompanied by slower productivity growth and more dispersion of wages, but that the underlying cause is a drop in the start-up rates of new firms and the dynamism of the US economy. They write:

"Our analysis is that there is mounting evidence that an important common cause has contributed to both the slowdown in productivity growth and the increase in inequality. The ultimate cause is a reduction in competition and dynamism that has been documented by Decker et al (2014, 2018) and many others. This reduction is partly a “natural” reflection of trends like the increased importance of network externalities and partly a “manmade” reflection of policy choices, like increased regulatory barriers to entry. These increased rigidities have contributed to the rise in concentration and increased dispersion of firm-level profitability. The result is less innovation, either through a straightforward channel of less investment or through broader factors such as firms not wanting to cannibalize on their own market shares. At the same time, these channels have also contributed to rising inequality in a number of different ways ..."

Here are a couple more articles I found useful in thinking about these issues, and in particular about the cases of Google and Amazon.

Charles Duhigg wrote "The Case Against Google," in the New York Times Magazine (February 20, 2018). He notes that a key issue in antitrust enforcement is whether a large firm is actively undermining potential competitors, and offers some examples of small companies are pursuing legal action because they felt undermined. If Google is using its search functions and business connections to disadvantage firms that are potential competitors, then that's a legitimate antitrust issue. Duhigg also argues that if Microsoft had not been sued for this type of anticompetitive behaviour about 20 years ago, it might have killed off Google.

The argument that Google uses its search functions to disadvantage competitors reminds me of the longstanding antitrust arguments about computer reservation systems in the airline industry. Going back to the late 1980s, airlines like United and American build their own computer reservation systems, which were then used by travel agents. While in theory the systems listed all flights, the airlines also had a tendency to list their own flights more prominently, and there was some concern that they could also adjust prices for their own flights more quickly. Such lawsuits continue up to the present. The idea that a firm can use search functions to disadvantage competitors, and that such behavior is anticompetitive under certain conditions, is well-accepted in existing antitrust law.

As Duhigg notes, the European antitrust authorities have found against Google. "Google was ordered to stop giving its own comparison-shopping service an illegal advantage and was fined an eye-popping $2.7 billion, the largest such penalty in the European Commission’s history and more than twice as large as any such fine ever levied by the United States." As you might imagine, the case remains under vigorous appeal and dispute.

As a starting point for thinking about Amazon and anticompetitive issues, I'd recommend Lina M. Khan's article on "Amazon's Antitrust Paradox" (Yale Law Journal, January 2017, pp. 710-805). From the abstract:

"Amazon is the titan of twenty-first century commerce. In addition to being a retailer, it is now a marketing platform, a delivery and logistics network, a payment service, a credit lender, an auction house, a major book publisher, a producer of television and films, a fashion designer, a hardware manufacturer, and a leading host of cloud server space. Although Amazon has clocked staggering growth, it generates meager profits, choosing to price below-cost and expand widely instead. Through this strategy, the company has positioned itself at the center of e-commerce and now serves as essential infrastructure for a host of other businesses that depend upon it. Elements of the firm’s structure and conduct pose anticompetitive concerns—yet it has escaped antitrust scrutiny.

"This Note argues that the current framework in antitrust—specifically its pegging competition to `consumer welfare,' defined as short-term price effects—is unequipped to capture the architecture of market power in the modern economy. We cannot cognize the potential harms to competition posed by Amazon’s dominance if we measure competition primarily through price and output. Specifically, current doctrine underappreciates the risk of predatory pricing and how integration across distinct business lines may prove anticompetitive. These concerns are heightened in the context of online platforms for two reasons. First, the economics of platform markets create incentives for a company to pursue growth over profits, a strategy that investors have rewarded. Under these conditions, predatory pricing becomes highly rational—even as existing doctrine treats it as irrational and therefore implausible. Second, because online platforms serve as critical intermediaries, integrating across business lines positions these platforms to control the essential infrastructure on which their rivals depend. This dual role also enables a platform to exploit information collected on companies using its services to undermine them as competitors."This passage summarizes the conceptual issue. In effect, it argues that Amazon may be good for consumers (at least in the short-run of some years), but still have potential "harms for competition." The idea that antitrust authorities should act in a way that hurts consumers in the short run, on the grounds that it will add to competition that will benefit consumers in the long run, would be a stretch for current antitrust doctrine--and if applied too broadly could lead to highly problematic results. Khan's article is a good launching-pad for that discussion.

3) Should bigness be viewed as bad for political reasons, even if it is beneficial for consumers?

The touchstone of antitrust analysis has for some decades now been whether consumers benefit. Other factors like whether workers lose their jobs or small businesses are driven into bankruptcy do not count. Neither does the potential for political clout being wielded by large firms. But the argument that antitrust should go beyond efficiency that benefits consumers has a long history, and seems to be making a comeback.

Daniel A. Crane discusses these issues in "Antitrust’s Unconventional Politics The ideological and political motivations for antitrust policy do not neatly fit the standard left/right dichotomy," appearing in Regulation magazine (Summer 2018, pp. 18-22).

"Although American antitrust policy has been influenced by a wide variety of ideological schools, two influences stand out as historically most significant to understanding the contemporary antitrust debate. The first is a Brandeisian school, epitomized in the title of Louis Brandeis’s 1914 essay in Harper’s Weekly, “The Curse of Bigness.” Arguing for `regulated competition' over `regulated monopoly,' he asserted that it was necessary to `curb[...] physically the strong, to protect those physically weaker' in order to sustain industrial liberty. He evoked a Jeffersonian vision of a social-economic order organized on a small scale, with atomistic competition between a large number of equally advantaged units. His goals included the economic, social, and political. ... The Brandeisian vision held sway in U.S. antitrust from the Progressive Era through the early 1970s, albeit with significant interruptions. ...

"The ascendant Chicago School of the 1960s and 1970s threw down the gauntlet to the Brandeisian tendency of U.S. antitrust law. In an early mission statement, Bork and Ward Bowman characterized antitrust history as `vacillat[ing] between the policy of preserving competition and the policy of preserving competitors from their more energetic and efficient rivals,' the latter being an interpretation of the Brandeis School. Chicagoans argued that antitrust law should be concerned solely with economic efficiency and consumer welfare. `Bigness' was no longer necessarily a curse, but often the product of superior efficiency. Chicago criticized Brandeis’s `sympathy for small, perhaps inefficient, traders who might go under in fully competitive markets.' Preserving a level playing field meant stifling efficiency to enable market participation by the mediocre. Beginning in 1977–1978, the Chicago School achieved an almost complete triumph in the Supreme Court, at least in the limited sense that the Court came to adopt the economic efficiency/consumer welfare model as the exclusive or near exclusive goal of antitrust law ..."As Crane points out, the intellectual currents here have been entangled over time, reflecting our tangled social views of big business. The Roosevelt administration trumpeted the virtues of small business, until it decided that large consolidated firms would be better at getting the US economy out of the Great Depression and fighting World War II. After World War II, there was a right-wing fear that large consolidated firms were the pathway to a rise of government control over the economy and Communism, and Republicans pushed for more antitrust. In the modern economy, we are more likely to view unsuccessful firms as needing support and subsidy, and successful firms as having in some way competed unfairly. One of the reasons for focusing antitrust policy on consumer benefit was that it seemed clearly preferable to a policy that seemed focused on penalizing success and subsidizing weakness.

The working assumption of current antitrust policy is that no one policy can (or should) try to do everything. Yes, encouraging more business dynamism and start-ups is a good thing. Yes, concerns about workers who lose their jobs or companies that get shut down are a good thing. Yes, certain rules and restrictions on the political power of corporations are a good thing. But in the conventional view (to which I largely subscribe), antitrust is just one policy. It should focus on consumer welfare and specific anticompetitive behaviors by firms, but not become a sort of blank check for government to butt in and micromanage successful firms.