China's trade surpluses exploded in size after 2001, when China joined the World Trade Organization and its exports soared. But those trade surpluses peaked back before the Great Recession and have dwindled since then to near-zero. Indeed, the IMF predicts that China is likely to have small trade deficits in the next few years. What happened? Pragyan Deb, Albe Gjonbalaj, and Swarnali A. Hannan tell the story in "The Drivers, Implications and Outlook for China’s Shrinking Current Account Surplus" (IMF Working Paper WP/19/244, November 8, 2019).

As a starting point, here's a graph showing China's overall trade balance (the "current account" line) falling to zero. The green line shows China's trade balance in services. The blue line shows China's trade balance in goods.Clearly, one big change is that China has started running a trade deficit in services (an area where the US economy runs a trade surplus). The main reason seems to be a large increase in outbound Chinese tourism, because in trade statistics, international tourists are in effect "importing" goods produced in other countries. The IMF economists write: "China’s tourism balance, mostly on account of outbound tourism, has swung from a small surplus of around 5bn USD in 2008 to a deficit of nearly 250bn USD in 2018, driven by the increasing purchasing power of the middle class and an appreciating currency. ... [T]he trend is undeniable. It is also borne out by an almost fourfold increase in the number of Chinese outbound visitors – from 46mn in 2008 to 162mn in 2018."

China's trade surplus in goods has also dropped substantially, especially from about 2007-2010, and has plateaued since then. Several major changes are behind this shift. One is that after China's dramatic expansion of exports, there wasn't a lot of room for additional increases. As the IMF economists put it,

In 2001, when China joined the WTO, the share of Chinese exports to total world exports was around 4 percent. This more than tripled to 13 percent in 2017. In the case of manufacturing, the corresponding figures are 5 and 17 percent respectively ... China is now the largest goods exporter in the world and its share of world exports declined in 2016 and 2017. ... [D]ividends from joining the World Trade Organization in 2001 have diminished and China already occupies a dominant position in many markets. ...Another shift is "rebalancing," which refers to China's gradual move toward being an economy that produces more for domestic consumption and relies less on exports. In thinking about this shift, it's useful to flash back to China's extraordinary surge of exports after 2001 and up to about 2007. In a flexible economy, this dramatic rise in export sales should have also led to equally dramatic rise in incomes--and thus to rise in consumption. But while China's wages did rise substantially during this time, it wasn't nearly enough to keep up with the export boom. Thus, China's export surge turned into a surge of national saving as well. This figure shows how China's national savings rate went from an extraordinarily high 35% of GDP back in 2000 to an unbelievably high level of more than 50% of GDP at the peak of the export surge around 2007.

However, China's savings rate has now come back down to merely extraordinary levels again. More specifically, the rates of corporate and government saving in China are close to world averages, but China's rate of household saving remains quite high. A common reason given is demography: China is still trying to build up its pension and social security system, and after four decades of the one-child policy, people don't have enough children to rely on them for old-age support, either. Thus, people saved at very high rates. But as China ages, and older people begin to spend rather than save, the household savings rate should drop, too.

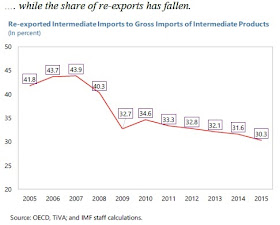

Instead of producing to sell abroad, the share of China's output that is being consumed in China is rising, as the pie charts show. The graph below that focuses on imports of "intermediate" products, which are then used in a production process. Back at the peak of China's trade surpluses around 2007, 43% of China's intermediate imports were being used for products that would be re-exported out of China; now, that share is down to about 30% as a greater share imports of intermediate goods are being used to produce goods consumed inside China.

Finally, one last part of the overall trade picture is called the "income balance," which looks at how much the economy of a country is receiving from its financial investments abroad, and hos much the economy is paying foreign investors for their investments within the country. With China's very large surpluses, it built up very large investments in foreign financial assets. However, it turns out that China's economy earns relatively little from those holdings of foreign assets, because a large share is invested in financial assets like US Treasury bonds that are paying a very low rate of return. Meanwhile, foreign investors in China are much more likely to own a chunk of a Chinese company or Chinese real estate, and thus have been receiving a much higher rate of return. Thus, even though China holds much more in foreign assets than foreign investors hold in Chinese assets, China's "income balance" is negative. The IMF economists write:

Despite sizeable foreign assets, China’s income account remains in deficit. This is because less than 30 percent of China’s external assets consist of higher yielding risky assets such as direct and equity portfolio investment. Most assets comprise of lower-yielding investments such as international reserve assets, trade credit, and foreign currency deposits. In contrast, 70 percent of China’s external liabilities comprise of riskier and therefore higher (expected) return instruments such as direct and portfolio equity investments.Putting all these factors together and projecting China's trade balance in the future, the IMF economists write:

Going forward, the [China's] small current account surplus recorded in 2018 is expected to turn into a small deficit in the medium term as the structural factors outlined above continue to drive up imports and moderate exports.China's shift to a trade balance of zero, or a small deficit, will cause a different set of echoes and consequences in the global economy. For example, there has been talk for some years now of a "global savings glut," driven in substantial part by the very high savings rates in China. n the last 20 years or so, this global savings glut from China is one reason that the US government has been able to sell its Treasury bonds at such a low rate of interest was because of how the global savings glut kept buying those bonds. The global saving glut is often given as a main reason why interest rates around the world are so low. But China's contribution to the global savings glut has been fading away.