The predicted slowdown in trade for 2020 is certainly no surprise, but the WTO report provided some context of patterns of trade since 2000 that seemed worth passing along.

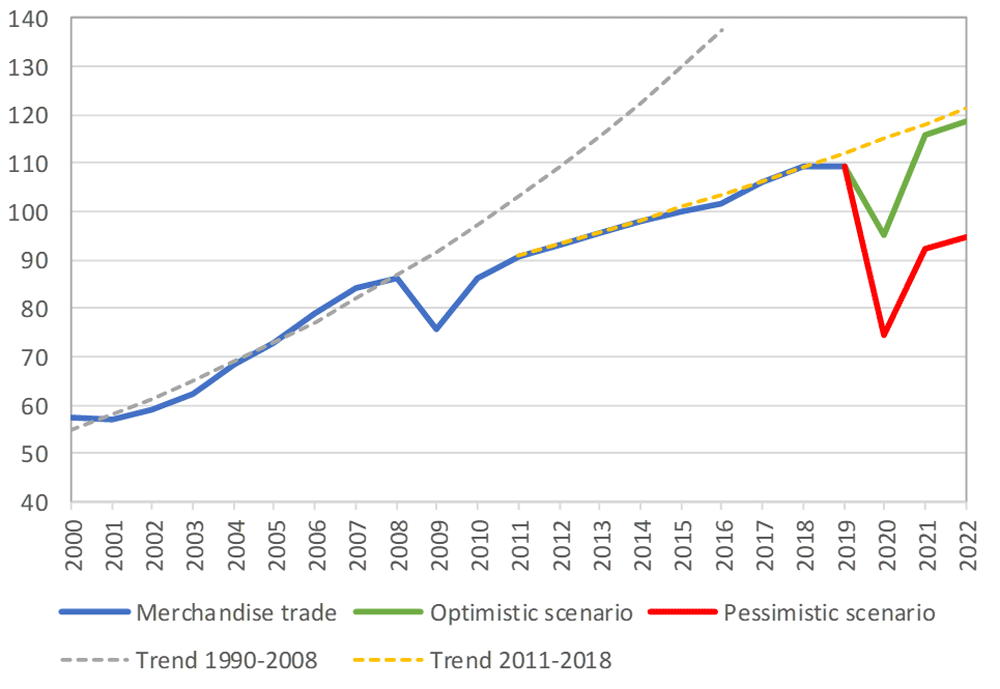

One is that global trade slowed down after about 2008. I suspect that much of this change reflects patterns from China, where exports were growing much faster than GDP from 2001 up to about 2007, but since then have growth more slowly than GDP. The blue dashed lie shows the trendline of global trade if predicting based on 2000-2008. The yellow dashed line shows the flatter trendline predicting based on on the years 2011-2018. The red and green lines show a range of trade projections for 2020 through 2022. Again, for those who see international trade as a destructive force, the slowdown after about 2008 and the sharp drop expected for 2020 should presumably be worth celebrating.

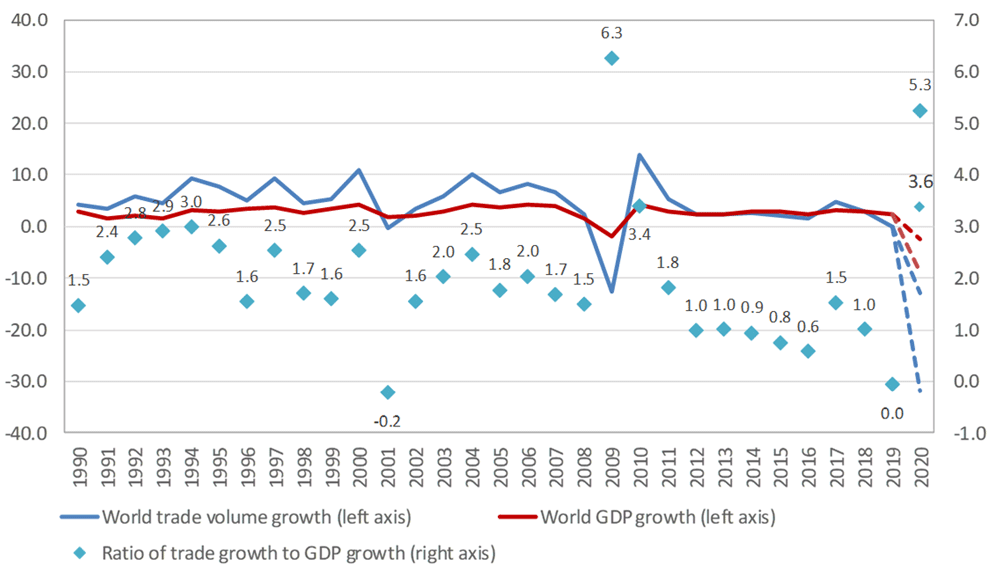

There's a classic argument among economists as to whether trade should be viewed as a cause of economic growth, or whether trade is just a by-product of economic growth (see "Trade: Engine or Handmaiden of Growth?", January 23, 2017). I won't revisit those arguments here, but instead just show the pattern. The red line shows the annual rate of world GDP growth; the blue line shows growth in the volume of world trade. The blue diamonds show the ratio between trade growth and world GDP growth in each year.

Through the 1990s and into the 2000s, it was common for the growth rate of trade to be higher than the growth rate of world GDP, so the ratios on the left-hand side of the figure are typically bigger than 1, and sometimes bigger than two. But since about 2011, world GDP has commonly grown at the same speed as trade or somewhat slower, so ratios of 1.0 or less are more common. In 2019, trade growth was about zero, so the ratio was also about zero. For 2020, the ratio will presumably turn negative, because the rate of growth for trade will be considerably more negative than the (also negative) rate of growth for world GDP.

In particular, the WTO forecasts big falls in two subsets of international trade in 2020: the trade linked to global supply chains, and in services trade. The WTO writes:

Value chain disruption was already an issue when COVID‑19 was mostly confined to China. It remains a salient factor now that the disease has become more widespread. Trade is likely to fall more steeply in sectors characterized by complex value chain linkages, particularly in electronics and automotive products. According to the OECD Trade In Value Added (TiVa) database, the share of foreign value added in electronics exports was around 10% for the United States, 25% for China, more than 30% for Korea, greater than 40% for Singapore and more than 50% for Mexico, Malaysia and Vietnam. ...

Services trade may be the component of world trade most directly affected by COVID-19 through the imposition of transport and travel restrictions and the closure of many retail and hospitality establishments. Services are not included in the WTO's merchandise trade forecast, but most trade in goods would be impossible without them (e.g. transport). Unlike goods, there are no inventories of services to be drawn down today and restocked at a later stage. As a result, declines in services trade during the pandemic may be lost forever. Services are also interconnected, with air transport enabling an ecosystem of other cultural, sporting and recreational activities. However, some services may benefit from the crisis. This is true of information technology services, demand for which has boomed as companies try to enable employees to work from home and people socialise remotely.

I see a certain amount of casual jibber-jabber from both ends of the political spectrum about how at least this recession gives the US a chance to separate itself from the rest of the global economy. The disruptions and costs inherent in making such a change should not be taken lightly.