We all know that the United States has the highest level of income inequality of any high-income country. Right? But at least according to OECD statistics, this claim is only true if one looks at inequality after taxes and transfers. If one looks at inequality before income and taxes, the U.S. economy has less inequality than Germany, Italy, and the United Kingdom, and about the same amount of inequality as France. The OECD data also offers a hint as to why this unexpected (to me, at least) outcome occurs.

Start with the OECD numbers. The OECD uses the Gini coefficient to measure income inequality across high income. For an earlier post with an intuitive explanation and definition of the Gini coefficients, see here. For present purposes, it suffices to say that a Gini coefficient is a way of measuring inequality that theoretically can range from a score of zero for perfect equality, where everyone has exactly the same income, to a score of one for a situation of complete inequality, where one person receives all the income.

Here's a compilation of Gini coefficients from OECD data with the United States in the top row, followed by Canada, France, Germany, Italy, Japan, Sweden, and the United Kingdom. The OECD data for the second column is here, and data for the other columns is available by toggling the "Income and population measures" box at the top. All data is for the latest year available. (Thanks to Danlu Hu for putting together the table.)

As noted above, the U.S. has the highest Gini coefficient of these eight comparison countries if measured after taxes and transfers (second column), but not if measured before taxes and transfers (first column). However, a hint as to why this arises can be found in the last four columns, which break down the Gini coefficients by the working age population and the over-65 population.

When it comes to the working age population, before taxes and transfers, the U.S. level of inequality is third-highest, but virtually tied for first with the United Kingdom and Italy. After taxes and transfers, the U.S. level of inequality among the working age population clearly the highest.

When it comes to the over-65 population, before taxes and transfers, the U.S. has a far more equal distribution of income than France, Germany, and Italy. I haven't dug down into the data here, but I suspect that these numbers are reflecting that a much larger share of over-65 workers are still in the labor force in the U.S. economy--which makes the distribution more equal before taxes and transfers.

Taxes and transfers make the over-65 distribution of income far more equal in all eight countries, but the U.S. stands out as by far the least equal, followed by Japan, with both well behind the other six countries.

These patterns are consistent with a finding from an OECD report published last fall called Divided We Stand: Why Inequality Keeps Rising. I blogged about it on December 16, 2012, in "Government Redistribution : International Comparisons." One theme of the report is that the extent of government redistribution across populations is driven much more by the widespread provision of government benefits than by the progressivity of taxation. As the OECD report stated: "Benefits had a much stronger impact on inequality than the other main instruments of cash distribution -- social contributions or taxes. ... The most important benefit-related determining factor in overall distribution, however, was not benefit levels but the number of people entitled to transfers."

Showing posts with label inequality. Show all posts

Showing posts with label inequality. Show all posts

Thursday, March 29, 2012

Tuesday, February 28, 2012

The Great Gatsby Curve

The current chairman of the Council of Economic Advisers, Alan Krueger, has called it the Great Gatsby curve. (Full disclosure: Alan was editor of my own Journal of Economic Perspectives, and thus my direct boss, from 1996-2002.) Here is the curve, from the 2012 Economic Report of the President:

The horizontal axis of the diagram is a measure of economic inequality called the Gini coefficient. For a detailed explanation of how it is calculated, see my earlier here. For present purposes, suffice it to say that this scale runs on a scale where 0 is perfect equality, where all people have the same income, and 1 is perfect inequality, where one person has all the income. Using data for 1985, countries like the United States and Spain have high levels of income inequality, while Nordic countries like Sweden, Finland, Norway, and Denmark have relatively low levels.

The vertical axis of the diagram is labelled the "intergenerational earnings elasticity." This is a way of saying how how much the incomes of individuals are correlated with those of their parents. Here's the explanation from the Economic Report of the President:

"Family (or individual) incomes in one generation are also highly correlated with family (or individual) incomes in the next generation. In other words, the children of parents who are poor are more likely than

the children of well-off parents to be poor when they grow up. A common measure of mobility across generations is the intergenerational elasticity (IGE) of earnings or income, which is defined as the percentage difference in a child’s income associated with a 1 percent difference in the parent’s

income. ... Studies based on U.S. data ... suggest that plausible estimates of the average IGE between fathers and sons are between 0.4 and 0.6. An IGE of 0.4 means that if one father earned 20 percent more

than another over their lifetime, the first father’s son on average would earn 8 percent more than the second father’s son; an IGE of 0.6 means that the first father’s son would earn 12 percent more on average than the second father’s son. That is, the higher the IGE is, the lower economic mobility is between the generations."

Thus, the basic message of the Great Gatsby curve is that when a country has a higher level of income inequality at a point in time (the Gini coefficient on the horizontal axis), that country will also tend to experience less intergenerational mobility (that is, the correlation of income between one generation and the next will tend to be higher, on the vertical axis).

A first obvious question about this relationship is whether it is determined by some quirk in measurement: for example, would using different countries, or a different year, or different measures of inequality alter the relationship greatly? The Economic Report answers that question: "As other research has shown, the finding of a positive relationship between IGE and inequality ... is robust to alternative choices of countries, intergenerational mobility measures, and year in which income inequality is

measured ..."

Indeed, for economist who study this literature, the finding that the U.S. economy has less intergenerational mobility than many other high-income countries isn't even much of a surprise. For example, Gary Solon was listing evidence on this point in my own Journal of Economic Perspectives back in the Summer 2002 issue in his article, "Cross-Country Differences in Intergenerational Earnings Mobility." That issue also includes three other articles with theories and evidence on intergenerational mobility.

Bhashkar Mazumder of the Chicago Fed offers an overview of the path of intergenerational mobility over time in the United States. He writes: "After staying relatively stable for several decades, intergenerational

mobility appears to have declined sharply at some point between 1980 and 1990, a period in which both income inequality and the economic returns to education rose sharply. ... There is fairly consistent evidence that intergenerational mobility has stayed roughly constant since 1990 but remains below the rates of mobility experienced from 1950 to 1980."

Of course, income inequality has been high and growing in the United States since the 1985 data shown on the graph above. The clear implication is that the intergenerational earnings elasticity will continue to grow as well. In a January 2012 speech on these issues, Alan Krueger ventured a projection:

"While we will not know for sure whether, and how much, income mobility across generations has been

exacerbated by the rise in inequality in the U.S. until today’s children have grown up and completed their careers, we can use the Great Gatsby Curve to make a rough forecast. ... The IGE for the U.S. is predicted to rise from .47 to .56. In other words, the persistence in the advantages and disadvantages of income passed from parents to the children is predicted to rise by about a quarter for the next generation as a result of the rise in inequality that the U.S. has seen in the last 25 years."

The most common theoretical mechanism hypothesized for this connection between current inequality and less intergenerational mobility is the education system. Gary Solon did much of the early modelling on this issue: here's a description of that work from Mazumder:

"Economic models have emphasized the importance of parental investment in children’s human capital as one of the key mechanisms behind the intergenerational transmission of labor market earnings. One such model developed by Solon points to at least two important factors that could cause intergenerational

mobility to change over time: changes in the labor market returns to education and changes in the public provision of human capital. In periods where the returns to schooling are rising, the payoff to a given level of parental investment in children’s human capital will be larger, causing differences between families to persist longer and leading to a decline in intergenerational mobility. In contrast, during periods where public access to schooling becomes more widely available, then one might expect the intergenerational association to decline and mobility to rise."

In short, when the returns to human capital are especially high, inequality will be higher. In this situation, those with income will invest more in the education of their children, using education as a way to pass on their own economic position. Indeed, Mazumder also points to some evidence that "the difference

in test scores by family income has grown by 30% to 40% for children born in 2001 relative to those born in 1976."

As a solution, it's easy to say that we're all in favor of expanding education for those at the bottom of the income scale, but if that is indeed true, it's fair to say that we as a society have been doing a lousy job of accomplishing that goal over the last few decades. Indeed, we've been doing a lousy enough job as to make one wonder if a general broad rise in overall education levels--as opposed to better schools for their child or their town--really is a shared goal for many Americans. Work by Nobel laureate James Heckman and various co-authors has argued that the U.S. high school graduation rate, when consistently measured over time, peaked in the 1960s and has declined since then.

It's easy to say that "we're all in favor" of mobility between generations, but of course, in practice, many of us aren't. After all, the highest level of intergenerational mobility would mean zero correlation between incomes of parents and children. I earn an above-average income, and I invest time and energy and money make location choices so that my children will greater human capital and earn above-average incomes, too. Thus, I must admit that I do not favor completely free mobility of incomes. I'm sure I'm not alone. Divide the income distribution into fifths, and think about parents in the top fifth. How many of them would like to live in an economy where their children have an equal chance of ending up in any of the other fifths of the income distribution? (Megan McArdle makes this point with nice force in a blog post here.)

Those who would like an overview of some of the recent more technical debates over the Great Gatsby curve might usefully begin with this post by Miles Corak, an economist at the University of Ottawa who was one of the first to draw the curve.

The horizontal axis of the diagram is a measure of economic inequality called the Gini coefficient. For a detailed explanation of how it is calculated, see my earlier here. For present purposes, suffice it to say that this scale runs on a scale where 0 is perfect equality, where all people have the same income, and 1 is perfect inequality, where one person has all the income. Using data for 1985, countries like the United States and Spain have high levels of income inequality, while Nordic countries like Sweden, Finland, Norway, and Denmark have relatively low levels.

The vertical axis of the diagram is labelled the "intergenerational earnings elasticity." This is a way of saying how how much the incomes of individuals are correlated with those of their parents. Here's the explanation from the Economic Report of the President:

"Family (or individual) incomes in one generation are also highly correlated with family (or individual) incomes in the next generation. In other words, the children of parents who are poor are more likely than

the children of well-off parents to be poor when they grow up. A common measure of mobility across generations is the intergenerational elasticity (IGE) of earnings or income, which is defined as the percentage difference in a child’s income associated with a 1 percent difference in the parent’s

income. ... Studies based on U.S. data ... suggest that plausible estimates of the average IGE between fathers and sons are between 0.4 and 0.6. An IGE of 0.4 means that if one father earned 20 percent more

than another over their lifetime, the first father’s son on average would earn 8 percent more than the second father’s son; an IGE of 0.6 means that the first father’s son would earn 12 percent more on average than the second father’s son. That is, the higher the IGE is, the lower economic mobility is between the generations."

Thus, the basic message of the Great Gatsby curve is that when a country has a higher level of income inequality at a point in time (the Gini coefficient on the horizontal axis), that country will also tend to experience less intergenerational mobility (that is, the correlation of income between one generation and the next will tend to be higher, on the vertical axis).

A first obvious question about this relationship is whether it is determined by some quirk in measurement: for example, would using different countries, or a different year, or different measures of inequality alter the relationship greatly? The Economic Report answers that question: "As other research has shown, the finding of a positive relationship between IGE and inequality ... is robust to alternative choices of countries, intergenerational mobility measures, and year in which income inequality is

measured ..."

Indeed, for economist who study this literature, the finding that the U.S. economy has less intergenerational mobility than many other high-income countries isn't even much of a surprise. For example, Gary Solon was listing evidence on this point in my own Journal of Economic Perspectives back in the Summer 2002 issue in his article, "Cross-Country Differences in Intergenerational Earnings Mobility." That issue also includes three other articles with theories and evidence on intergenerational mobility.

Bhashkar Mazumder of the Chicago Fed offers an overview of the path of intergenerational mobility over time in the United States. He writes: "After staying relatively stable for several decades, intergenerational

mobility appears to have declined sharply at some point between 1980 and 1990, a period in which both income inequality and the economic returns to education rose sharply. ... There is fairly consistent evidence that intergenerational mobility has stayed roughly constant since 1990 but remains below the rates of mobility experienced from 1950 to 1980."

Of course, income inequality has been high and growing in the United States since the 1985 data shown on the graph above. The clear implication is that the intergenerational earnings elasticity will continue to grow as well. In a January 2012 speech on these issues, Alan Krueger ventured a projection:

"While we will not know for sure whether, and how much, income mobility across generations has been

exacerbated by the rise in inequality in the U.S. until today’s children have grown up and completed their careers, we can use the Great Gatsby Curve to make a rough forecast. ... The IGE for the U.S. is predicted to rise from .47 to .56. In other words, the persistence in the advantages and disadvantages of income passed from parents to the children is predicted to rise by about a quarter for the next generation as a result of the rise in inequality that the U.S. has seen in the last 25 years."

The most common theoretical mechanism hypothesized for this connection between current inequality and less intergenerational mobility is the education system. Gary Solon did much of the early modelling on this issue: here's a description of that work from Mazumder:

"Economic models have emphasized the importance of parental investment in children’s human capital as one of the key mechanisms behind the intergenerational transmission of labor market earnings. One such model developed by Solon points to at least two important factors that could cause intergenerational

mobility to change over time: changes in the labor market returns to education and changes in the public provision of human capital. In periods where the returns to schooling are rising, the payoff to a given level of parental investment in children’s human capital will be larger, causing differences between families to persist longer and leading to a decline in intergenerational mobility. In contrast, during periods where public access to schooling becomes more widely available, then one might expect the intergenerational association to decline and mobility to rise."

In short, when the returns to human capital are especially high, inequality will be higher. In this situation, those with income will invest more in the education of their children, using education as a way to pass on their own economic position. Indeed, Mazumder also points to some evidence that "the difference

in test scores by family income has grown by 30% to 40% for children born in 2001 relative to those born in 1976."

As a solution, it's easy to say that we're all in favor of expanding education for those at the bottom of the income scale, but if that is indeed true, it's fair to say that we as a society have been doing a lousy job of accomplishing that goal over the last few decades. Indeed, we've been doing a lousy enough job as to make one wonder if a general broad rise in overall education levels--as opposed to better schools for their child or their town--really is a shared goal for many Americans. Work by Nobel laureate James Heckman and various co-authors has argued that the U.S. high school graduation rate, when consistently measured over time, peaked in the 1960s and has declined since then.

It's easy to say that "we're all in favor" of mobility between generations, but of course, in practice, many of us aren't. After all, the highest level of intergenerational mobility would mean zero correlation between incomes of parents and children. I earn an above-average income, and I invest time and energy and money make location choices so that my children will greater human capital and earn above-average incomes, too. Thus, I must admit that I do not favor completely free mobility of incomes. I'm sure I'm not alone. Divide the income distribution into fifths, and think about parents in the top fifth. How many of them would like to live in an economy where their children have an equal chance of ending up in any of the other fifths of the income distribution? (Megan McArdle makes this point with nice force in a blog post here.)

Those who would like an overview of some of the recent more technical debates over the Great Gatsby curve might usefully begin with this post by Miles Corak, an economist at the University of Ottawa who was one of the first to draw the curve.

Friday, December 16, 2011

Government Redistribution : International Comparisons

Income inequality has been growing in most high-income countries around the world. How much do the redistribution policies of government hold down this growth in inequality? The OECD has published Divided We Stand: Why Inequality Keeps Rising. (The report can be read for free on-line with a slightly clunky browser, and a PDF of an "Overview" chapter can be downloaded.) Chapter 7 of the report discusses "Changes in Redistribution in OECD Countries Over Two Decades," which basically means from the mid-1980s to the mid-2000s. The chapter draws on a longer background paper that is freely available on-line: Herwig Immervoll and Linda Richardson's paper, "Redistribution Policy and Inequality Reduction in OECD Countries: What Has Changed in Two Decades?"

The United States does relatively little redistribution in comparison with other OECD countries. This graph from the "Overview" of the OECD report compares the inequality of market incomes to the inequality of disposable income after taxes and benefit payments. Inequality is measured by a Gini coefficient. For a more detailed explanation of how this is measured, see my November 1 post on Lorenz curves and Gini coefficients. But as a quick overview, it suffices to know that a Gini coefficient measures inequality on a scale from zero to 1, where zero is perfect equality where everyone has exactly the same income and 1 is perfect inequality where one person has all the income. The United States has one of the most unequal distributions of market income and of disposable income, and in this comparison group, U.S. policy does relatively little to reduce the disparity. The OECD writes: "Public cash transfers, as well as income taxes and social security contributions, played a major role in all OECD countries in reducing market-income inequality. Together, they

were estimated to reduce inequality among the working-age population (measured by the Gini coefficient) by an average of about one-quarter across OECD countries. This redistributive effect was larger in the Nordic countries, Belgium and Germany, but well below average in Chile, Iceland, Korea, Switzerland and the United States (Figure 9).

Any economy that has a progressive tax code and benefits for those with low incomes will find that as inequality increases, redistribution will also increase automatically as a result of these preexisting policies Some countries may also take additional steps, when faced with rising inequality of market incomes, to raise the amount of redistribution. A table in Ch. 7 of the OECD report calculates how much of the increase in increase in market incomes from the mid-1980s to the mid-2000s was offset by a rise in redistribution.

Denmark is the extreme case: increased redistribution from the mid-1980s to the mid-2000s offset more than 100% of the rise in inequality of market incomes. In a number of countries, the rise in redistribution offset from 35-55% of the rise in inequality of market incomes over this time period: Australia, Canada, West Germany, Netherlands, Norway, Sweden. By comparison, in the U.S. the rise in government redistribution from the mid-1980s to the mid-2000s offset just 9% of the rise in market inequality.

It's useful to look at redistribution policies both from the tax side and the benefits side. The striking theme that emerges is that in most countries, benefits for those with low incomes are much more important in reducing inequality than are progressive tax rates.

On the tax side, the U.S. tax code is already highly progressive compared with these other countries. The OECD published at 2008 report called "Growing Unequal: Income Distribution and Poverty in OECD Countries, which states (pp. 104-106): "Taxation is most progressively distributed in the United States, probably reflecting the greater role played there by refundable tax credits, such as the Earned Income Tax Credit and the Child Tax Credit. ... Based on the concentration coefficient of household taxes, the United States has the most progressive tax system and collects the largest share of taxes from the richest 10% of the population. However, the richest decile in the United States has one of the highest shares of market income of any OECD country.After standardising for this underlying inequality ... Australia and the United States collect the most tax from people in the top decile relative to the share of market income that they earn."

This finding is surprising to a lot of Americans, who have a sort of instinctive feeling that Europeans must be taxing the rich far more heavily. But remember that European countries rely much more on value-added taxes (a sort of national sales tax collected from producers) and on high energy taxes. They also often have very high payroll taxes to finance retirement programs. These kinds of taxes place a heavier burden on those with lower incomes.

In addition, top income tax rates all over the world have come down in recent decades, and the U.S. top rate is near a fairly common level. From the "Overview: "Top rates of personal income tax, which were in the order of 60-70% in major OECD countries, fell to around 40% on average by the late 2000s." From the

Immervoll and Richardson working paper: "Reductions in top [personal income tax] rates were steepest in Japan (from 70 to 37 percent), Italy (65 to 43), United Kingdom (60 to 40), and France (65 to 48). The flattening of schedules mostly concerned higher income ranges (Australia, Austria, Finland, France, Germany, Japan, United Kingdom, United States)."

The real difference in how much redistribution affects inequality arises from differences in benefits. The OECD writes: "Benefits had a much stronger impact on inequality than the other main instruments of cash distribution -- social contributions or taxes. ... The most important benefit-related determining factor in overall distribution, however, was not benefit levels but the number of people entitled to transfers." This theme applies to a number of benefit programs, including disability payments. But here is an illustrations with regard to unemployment insurance, taken from the Immervoll and Richardson working paper. They write: "Figure 11 indicates that the shares of unemployed reporting benefit receipt have dropped in a majority (two thirds) of the countries shown, while only a few recorded significant increases." Notice that the share of the unemployed in the U.S. who get unemployment benefits is on the low end of the spectrum.

This pattern also fits with my post on November 1 about a Congressional Budget Office report which found that Federal Redistribution is Dropping. It pointed out that the share of federal redistribution spending programs going to the elderly has been steadily rising, while the share going to the non-elderly poor and near-poor has not been rising. The working paper also notes: "[O]ver time, almost all countries devoted declining shares of total spending to cash benefits that mostly benefit children and working-age individuals."

The OECD report been criticized for suggesting that higher taxes on those with the very highest incomes might be worth considering, but this is certainly not the main focus of the report. Indeed, given that the U.S. tax system is already one of the most progressive, this recommendation seems aimed more at other countries than at the United States. The "Overview" of the OECD report states: "However, redistribution strategies based on government transfers and taxes alone would be neither effective nor financially sustainable. First, there may be counterproductive disincentive effects if benefit and tax reforms are not well designed. Second, most OECD countries currently operate under a reduced fiscal space which exerts strong pressure to curb public social spending and raise taxes. Growing employment may contribute to sustainable cuts in income inequality, provided the employment gains occur in jobs that offer career prospects. Policies for more and better jobs are more important than ever." In particular, the OECD report emphasizes as policy tools to fight unemployment job-related training and education, continuing education over the work life, and reforming rules prevalent in many countries that separate the workforce into temporary and permanent employment contracts.

As part of an overall plan to get the budget deficit under control, and given the rise in inequality over recent decades, I would be favor a somewhat higher marginal tax rate on those with very high income levels. But it seems to me that U.S. political discourse has focuses way too much on taxing the rich. Hard-core Democrats and Republicans both like the familiar arguments over taxes: it gets their blood pumping and their base motivated. But U.S. political discourse has far too little about reforming labor markets to open up more jobs, or about how to stimulate job-related education for life. And neither party stands up for raising government spending in ways that would affect those with lower income levels more, whether through income payments to families (especially to the working poor) or through spending on public goods like neighborhood safety (police, lighting and activities), parks and libraries, or education and public health that would have a greater effect on the quality of life for those with lower incomes.

The United States does relatively little redistribution in comparison with other OECD countries. This graph from the "Overview" of the OECD report compares the inequality of market incomes to the inequality of disposable income after taxes and benefit payments. Inequality is measured by a Gini coefficient. For a more detailed explanation of how this is measured, see my November 1 post on Lorenz curves and Gini coefficients. But as a quick overview, it suffices to know that a Gini coefficient measures inequality on a scale from zero to 1, where zero is perfect equality where everyone has exactly the same income and 1 is perfect inequality where one person has all the income. The United States has one of the most unequal distributions of market income and of disposable income, and in this comparison group, U.S. policy does relatively little to reduce the disparity. The OECD writes: "Public cash transfers, as well as income taxes and social security contributions, played a major role in all OECD countries in reducing market-income inequality. Together, they

were estimated to reduce inequality among the working-age population (measured by the Gini coefficient) by an average of about one-quarter across OECD countries. This redistributive effect was larger in the Nordic countries, Belgium and Germany, but well below average in Chile, Iceland, Korea, Switzerland and the United States (Figure 9).

Any economy that has a progressive tax code and benefits for those with low incomes will find that as inequality increases, redistribution will also increase automatically as a result of these preexisting policies Some countries may also take additional steps, when faced with rising inequality of market incomes, to raise the amount of redistribution. A table in Ch. 7 of the OECD report calculates how much of the increase in increase in market incomes from the mid-1980s to the mid-2000s was offset by a rise in redistribution.

Denmark is the extreme case: increased redistribution from the mid-1980s to the mid-2000s offset more than 100% of the rise in inequality of market incomes. In a number of countries, the rise in redistribution offset from 35-55% of the rise in inequality of market incomes over this time period: Australia, Canada, West Germany, Netherlands, Norway, Sweden. By comparison, in the U.S. the rise in government redistribution from the mid-1980s to the mid-2000s offset just 9% of the rise in market inequality.

It's useful to look at redistribution policies both from the tax side and the benefits side. The striking theme that emerges is that in most countries, benefits for those with low incomes are much more important in reducing inequality than are progressive tax rates.

On the tax side, the U.S. tax code is already highly progressive compared with these other countries. The OECD published at 2008 report called "Growing Unequal: Income Distribution and Poverty in OECD Countries, which states (pp. 104-106): "Taxation is most progressively distributed in the United States, probably reflecting the greater role played there by refundable tax credits, such as the Earned Income Tax Credit and the Child Tax Credit. ... Based on the concentration coefficient of household taxes, the United States has the most progressive tax system and collects the largest share of taxes from the richest 10% of the population. However, the richest decile in the United States has one of the highest shares of market income of any OECD country.After standardising for this underlying inequality ... Australia and the United States collect the most tax from people in the top decile relative to the share of market income that they earn."

This finding is surprising to a lot of Americans, who have a sort of instinctive feeling that Europeans must be taxing the rich far more heavily. But remember that European countries rely much more on value-added taxes (a sort of national sales tax collected from producers) and on high energy taxes. They also often have very high payroll taxes to finance retirement programs. These kinds of taxes place a heavier burden on those with lower incomes.

In addition, top income tax rates all over the world have come down in recent decades, and the U.S. top rate is near a fairly common level. From the "Overview: "Top rates of personal income tax, which were in the order of 60-70% in major OECD countries, fell to around 40% on average by the late 2000s." From the

Immervoll and Richardson working paper: "Reductions in top [personal income tax] rates were steepest in Japan (from 70 to 37 percent), Italy (65 to 43), United Kingdom (60 to 40), and France (65 to 48). The flattening of schedules mostly concerned higher income ranges (Australia, Austria, Finland, France, Germany, Japan, United Kingdom, United States)."

The real difference in how much redistribution affects inequality arises from differences in benefits. The OECD writes: "Benefits had a much stronger impact on inequality than the other main instruments of cash distribution -- social contributions or taxes. ... The most important benefit-related determining factor in overall distribution, however, was not benefit levels but the number of people entitled to transfers." This theme applies to a number of benefit programs, including disability payments. But here is an illustrations with regard to unemployment insurance, taken from the Immervoll and Richardson working paper. They write: "Figure 11 indicates that the shares of unemployed reporting benefit receipt have dropped in a majority (two thirds) of the countries shown, while only a few recorded significant increases." Notice that the share of the unemployed in the U.S. who get unemployment benefits is on the low end of the spectrum.

This pattern also fits with my post on November 1 about a Congressional Budget Office report which found that Federal Redistribution is Dropping. It pointed out that the share of federal redistribution spending programs going to the elderly has been steadily rising, while the share going to the non-elderly poor and near-poor has not been rising. The working paper also notes: "[O]ver time, almost all countries devoted declining shares of total spending to cash benefits that mostly benefit children and working-age individuals."

The OECD report been criticized for suggesting that higher taxes on those with the very highest incomes might be worth considering, but this is certainly not the main focus of the report. Indeed, given that the U.S. tax system is already one of the most progressive, this recommendation seems aimed more at other countries than at the United States. The "Overview" of the OECD report states: "However, redistribution strategies based on government transfers and taxes alone would be neither effective nor financially sustainable. First, there may be counterproductive disincentive effects if benefit and tax reforms are not well designed. Second, most OECD countries currently operate under a reduced fiscal space which exerts strong pressure to curb public social spending and raise taxes. Growing employment may contribute to sustainable cuts in income inequality, provided the employment gains occur in jobs that offer career prospects. Policies for more and better jobs are more important than ever." In particular, the OECD report emphasizes as policy tools to fight unemployment job-related training and education, continuing education over the work life, and reforming rules prevalent in many countries that separate the workforce into temporary and permanent employment contracts.

As part of an overall plan to get the budget deficit under control, and given the rise in inequality over recent decades, I would be favor a somewhat higher marginal tax rate on those with very high income levels. But it seems to me that U.S. political discourse has focuses way too much on taxing the rich. Hard-core Democrats and Republicans both like the familiar arguments over taxes: it gets their blood pumping and their base motivated. But U.S. political discourse has far too little about reforming labor markets to open up more jobs, or about how to stimulate job-related education for life. And neither party stands up for raising government spending in ways that would affect those with lower income levels more, whether through income payments to families (especially to the working poor) or through spending on public goods like neighborhood safety (police, lighting and activities), parks and libraries, or education and public health that would have a greater effect on the quality of life for those with lower incomes.

Thursday, December 8, 2011

Rising Income Economic Inequality: Video Discussions

Each fall, Haverford College holds an "Economics Alumni Forum." In October, Jane Dokko (class of '98) and I (class of '82) discussed "Rising Income Inequality: Causes and Consequences." Jane and I loosely divided up the subject by having her focus more on U.S. experience with income inequality in recent decades, while I focused more on long-term historical patterns like the old Kuznets curve arguments, along with international and global patterns of inequality.

A press release summarizing the presentations is here. A video of the presentations, roughly an hour in length, is available here. My presentation starts about 32 minutes into the forum.

Added: Greg Mankiw has posted at his website a video presentation of a symposium of Harvard professors discussing inequality, including economists Larry Katz and Ed Glaeser. It's about 80 minutes long, available here.

A press release summarizing the presentations is here. A video of the presentations, roughly an hour in length, is available here. My presentation starts about 32 minutes into the forum.

Added: Greg Mankiw has posted at his website a video presentation of a symposium of Harvard professors discussing inequality, including economists Larry Katz and Ed Glaeser. It's about 80 minutes long, available here.

Tuesday, November 1, 2011

Lorenz curves and Gini coefficients: CBO #3.

This is the third of three posts based on the the Congressional Budget Office report, "Trends in the Distribution of Household Income Between 1979 and 2007." The first was Incomes of the Top 1%, and the second was about Federal Redistribution is Dropping.

This post focuses on explaining some basic tools for measuring inequality. The Lorenz curve offers an intuitively clear picture of inequality. The Gini coefficient, which is based on the curve, offers a way of measuring inequality across the income distribution as a single number--and thus is often used in graphs and figures about inequality. The CBO report has a nice clear explanation of these topics.

The Lorenz curve

The Lorenz curve was developed by an American statistician and economist named Max Lorenz when he was a graduate student at the University of Wisconsin. His article on the the topic

The Gini coefficient

The Gini coefficient was developed by an Italian statistician (and noted fascist thinker) Corrado Gini in a 1912 paper written in Italian (and to my knowledge not freely available on the web). The intuition is straightforward (although the mathematical formula will look a little messier). On a Lorenz curve, greater equality means that the line based on actual data is closer to the 45-degree line that shows a perfectly equal distribution. Greater inequality means that the line based on actual data will be more "bowed" away from the 45-degree line. The Gini coefficient is based on the area between the 45-degree line and the actual data line. As the CBO writes:

"The Gini index is equal to twice the area between the 45-degree line and the Lorenz curve. Once again, the

extreme cases of complete equality and complete inequality bound the measure. At one extreme, if

income was evenly distributed and the Lorenz curve followed the 45-degree line, there would be no area

between the curve and the line, so the Gini index would be zero. At the other extreme, if all income was

in the highest income group, the area between the line and the curve would be equal to the entire area

under the line, and the Gini index would equal one. The Gini index for [U.S.] after-tax income in 2007 was

0.489—about halfway between those two extremes."

This post focuses on explaining some basic tools for measuring inequality. The Lorenz curve offers an intuitively clear picture of inequality. The Gini coefficient, which is based on the curve, offers a way of measuring inequality across the income distribution as a single number--and thus is often used in graphs and figures about inequality. The CBO report has a nice clear explanation of these topics.

The Lorenz curve

The Lorenz curve was developed by an American statistician and economist named Max Lorenz when he was a graduate student at the University of Wisconsin. His article on the the topic

"Methods of Measuring the Concentration of Wealth," appeared in Publications of the American Statistical Association , Vol. 9, No. 70 (Jun., 1905), pp. 209-219. The CBO report explains it this way:

"The cumulative percentage of income can be plotted against the cumulative percentage of the population, producing a so-called Lorenz curve (see the figure). The more even the income distribution is, the closer to a 45-degree line the Lorenz curve is. At one extreme, if each income group had the same income, then the cumulative income share would equal the cumulative population share, and the Lorenz curve would follow the 45-degree line, known as the line of equality. At the other extreme, if the highest income group earned all the income, the Lorenz curve would be flat across the vast majority of the income range,following the bottom edge of the figure, and then jump to the top of the figure at the very right-hand edge.

Lorenz curves for actual income distributions fall between those two hypothetical extremes. Typically, they intersect the diagonal line only at the very first and last points. Between those points, the curves are bow-shaped below the 45-degree line. The Lorenz curve of market income falls to the right and below the curve for after-tax income, reflecting its greater inequality. Both curves fall to the right and below the line of equality, reflecting the inequality in both market income and after-tax income."

The Gini coefficient

The Gini coefficient was developed by an Italian statistician (and noted fascist thinker) Corrado Gini in a 1912 paper written in Italian (and to my knowledge not freely available on the web). The intuition is straightforward (although the mathematical formula will look a little messier). On a Lorenz curve, greater equality means that the line based on actual data is closer to the 45-degree line that shows a perfectly equal distribution. Greater inequality means that the line based on actual data will be more "bowed" away from the 45-degree line. The Gini coefficient is based on the area between the 45-degree line and the actual data line. As the CBO writes:

"The Gini index is equal to twice the area between the 45-degree line and the Lorenz curve. Once again, the

extreme cases of complete equality and complete inequality bound the measure. At one extreme, if

income was evenly distributed and the Lorenz curve followed the 45-degree line, there would be no area

between the curve and the line, so the Gini index would be zero. At the other extreme, if all income was

in the highest income group, the area between the line and the curve would be equal to the entire area

under the line, and the Gini index would equal one. The Gini index for [U.S.] after-tax income in 2007 was

0.489—about halfway between those two extremes."

Federal Redistribution is Dropping: CBO #2

This is the second of three posts on the recent Congressional Budget Office Report "Trends in the Distribution of Household Income Between 1979 and 2007." The first post on Incomes of the Top 1% is here, while the third explains the concepts of the Lorenz Curve and the Gini Coefficient.

The federal government can redistribute income in two ways: by taking those with high incomes relatively more, and by making transfer payments to those with lower income. Using the Gini index (explained in the third post in this grouping) as a measure of inequality, CBO reports: "The dispersion of after-tax income in 2007 is about four-fifths as large as the dispersion of market income. Roughly 60 percent of the difference in dispersion between market income and after-tax income is attributable to transfers and roughly 40 percent is attributable to federal taxes.The redistributive effect of transfers and federal taxes was smaller in 2007 than in 1979 ..."

Redistribution through federal taxes

Here are three figures showing average federal tax rates paid by the top 1% of the income distribution in each year from 1979 to 2007, by the 81st to 99th percentiles, the 21st to 80th percentiles, and the lowest 20%. The first graph shows average payments as a share of income for individual income tax, the second shows payroll taxes, and the third shows all federal taxes combined. Here are a few patterns that jump out.

These sorts of graphs always turn my mind to Warren Buffett, and his claim that he pays less in taxes than his secretaries. For example, see Buffett's August 14 article, "Stop Coddling the Super-Rich," in the New York Times, where he writes: "Last year my federal tax bill — the income tax I paid, as well as payroll taxes paid by me and on my behalf — was $6,938,744. That sounds like a lot of money. But what I paid was only 17.4 percent of my taxable income — and that’s actually a lower percentage than was paid by any of the other 20 people in our office. Their tax burdens ranged from 33 percent to 41 percent and averaged 36 percent."

What Buffett pays as a share of income sounds plausible to me: he is well-known for taking a fairly small annual salary and then receiving most of his income in the form of gains from his investments. Because many of the investments have been held for long periods of time, they are subject to a lower capital gains tax rate. But the tax burdens that Buffett claims for his staff look unrealistically high. Let's say his office staff are in the 81st-99th percentiles of the income distribution. Average tax rates for that group are in the range of 22-23% in recent years. Buffett's staff might face a marginal tax rate might be 36% or 41%, depending on rules bout phase-outs of deductions and the like. But if Buffett's staff really are paying an average federal tax rate of 36% as a share of total income, they need access to better accountants or tax lawyer.

Redistribution through federal transfer payments

Federal government transfer payments are about 10-12% of household market income from 1979 to 2007. Spending in this category is heavily driven by Social Security and Medicare. In recent years, about half of federal transfer spending is Social Security. A third is health-related programs like Medicare and Medicaid. The rest is programs like unemployment insurance and welfare.

The share of federal transfer spending on the elderly is rising. In 1979 about 62% of all federal transfer payments went to elderly childless households, while about 19% went to nonelderly childless households and another 19% to households with children. By 2007, 69% of all federal transfer payments went to elderly childless households. The share going to nonelderly childless households stayed about the same, and the share going to households with children fell to about 11%.

Of course, Social Security and Medicare are not means-tested programs, so as they took a larger share of the federal transfer pie, the share going to the poor declined. Not coincidentally, back in 1979 about 54% of federal transfers went to households in the lowest quintile of income; by 2007, only about 36% of federal transfers went to households in the lowest quintile of income.

Summing up the redistribution by federal taxes and transfers

Here's a final figure showing how federal transfers and taxes affect income inequality, which is measured by the percent amount that these policies reduce the Gini index of inequality. The extent to which these policies reduce income inequality dropped in the 1980s, rose in the early 1990s, dropped in the late 1990s, rose in the early 2000s and has fallen since then. Interestingly, the diminished effect of federal redistribution since the mid-1990s is, by this measure, much more traceable to the changes in transfer payments than to the changes in progressivity of taxes.

The federal government can redistribute income in two ways: by taking those with high incomes relatively more, and by making transfer payments to those with lower income. Using the Gini index (explained in the third post in this grouping) as a measure of inequality, CBO reports: "The dispersion of after-tax income in 2007 is about four-fifths as large as the dispersion of market income. Roughly 60 percent of the difference in dispersion between market income and after-tax income is attributable to transfers and roughly 40 percent is attributable to federal taxes.The redistributive effect of transfers and federal taxes was smaller in 2007 than in 1979 ..."

Redistribution through federal taxes

Here are three figures showing average federal tax rates paid by the top 1% of the income distribution in each year from 1979 to 2007, by the 81st to 99th percentiles, the 21st to 80th percentiles, and the lowest 20%. The first graph shows average payments as a share of income for individual income tax, the second shows payroll taxes, and the third shows all federal taxes combined. Here are a few patterns that jump out.

- The top 1% pays more of its income on average in income taxes, but much less in terms of payroll taxes. Of course, this is the income on which Social Security payroll taxes must be paid is capped, so such taxes are a smaller share of income for those with very high incomes.

- With income taxes, the lowest quintile pays on average a negative tax rate: that is, with refundable tax credits, they receive more from the federal government through the tax code than they pay.

- Total taxes paid as a share of income have dropped off somewhat for all groups in the last decade or so; if one looks back to the mid-1990s, the drop in tax rates for the top 1% looks larger than for other groups.

- The overall patterns here seem to be that the federal tax code as a whole became less progressive in the 1980s, more progressive in the 1990s, and since then has either not changed or become slightly less progressive, depending on what statistical measure one chooses to emphasize.

These sorts of graphs always turn my mind to Warren Buffett, and his claim that he pays less in taxes than his secretaries. For example, see Buffett's August 14 article, "Stop Coddling the Super-Rich," in the New York Times, where he writes: "Last year my federal tax bill — the income tax I paid, as well as payroll taxes paid by me and on my behalf — was $6,938,744. That sounds like a lot of money. But what I paid was only 17.4 percent of my taxable income — and that’s actually a lower percentage than was paid by any of the other 20 people in our office. Their tax burdens ranged from 33 percent to 41 percent and averaged 36 percent."

What Buffett pays as a share of income sounds plausible to me: he is well-known for taking a fairly small annual salary and then receiving most of his income in the form of gains from his investments. Because many of the investments have been held for long periods of time, they are subject to a lower capital gains tax rate. But the tax burdens that Buffett claims for his staff look unrealistically high. Let's say his office staff are in the 81st-99th percentiles of the income distribution. Average tax rates for that group are in the range of 22-23% in recent years. Buffett's staff might face a marginal tax rate might be 36% or 41%, depending on rules bout phase-outs of deductions and the like. But if Buffett's staff really are paying an average federal tax rate of 36% as a share of total income, they need access to better accountants or tax lawyer.

Redistribution through federal transfer payments

Federal government transfer payments are about 10-12% of household market income from 1979 to 2007. Spending in this category is heavily driven by Social Security and Medicare. In recent years, about half of federal transfer spending is Social Security. A third is health-related programs like Medicare and Medicaid. The rest is programs like unemployment insurance and welfare.

The share of federal transfer spending on the elderly is rising. In 1979 about 62% of all federal transfer payments went to elderly childless households, while about 19% went to nonelderly childless households and another 19% to households with children. By 2007, 69% of all federal transfer payments went to elderly childless households. The share going to nonelderly childless households stayed about the same, and the share going to households with children fell to about 11%.

Of course, Social Security and Medicare are not means-tested programs, so as they took a larger share of the federal transfer pie, the share going to the poor declined. Not coincidentally, back in 1979 about 54% of federal transfers went to households in the lowest quintile of income; by 2007, only about 36% of federal transfers went to households in the lowest quintile of income.

Summing up the redistribution by federal taxes and transfers

Here's a final figure showing how federal transfers and taxes affect income inequality, which is measured by the percent amount that these policies reduce the Gini index of inequality. The extent to which these policies reduce income inequality dropped in the 1980s, rose in the early 1990s, dropped in the late 1990s, rose in the early 2000s and has fallen since then. Interestingly, the diminished effect of federal redistribution since the mid-1990s is, by this measure, much more traceable to the changes in transfer payments than to the changes in progressivity of taxes.

Monday, October 31, 2011

Income of the Top 1%: CBO #1

The Congressional Budget Office has put out a report on "Trends in the Distribution of Household Income Between 1979 and 2007." It's a treasure trove of useful figures and explanations. I can't resist offering a bunch of highlights, which I will divide into three posts--with this as the first one.

While it is certainly true that the top 1% is a group that evolves over time, this point shouldn't be pushed too hard. Inequality as measured by annual income is rising; however, I don't know of any evidence that mobility between broad income groups has been rising. Greater inequality isn't being offset by greater mobility.

Here's a graph showing the cumulative percentage growth in after-tax, after-transfer income for various income groups, measured on an annual basis. Income growth is slowest for t hose in the lowest quintile (or fifth) of the income distribution, and then faster in ascending order for those in the 21st to 80th percentiles, the 81st to 99th percentiles, and the top 1%. The percentage gains for the top 1% are remarkably higher than for the other groups.

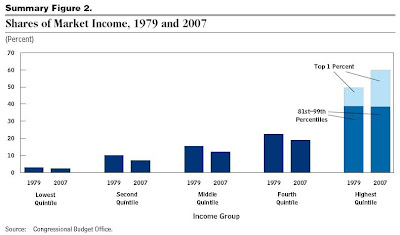

One can look at this underlying data in a different way: What share of total market income did these groups receive in 1979, compared to 2007? And what share of after-tax, after-transfer income did these groups receive in 1979, compared to 2007? The timeframe is a useful one, because it runs from one business cycle peak just before a deep recession in 1979 to another year that is a business cycle peak just before a deep recession. Thus, patterns over this time can't be attributed to comparing a recession year to a nonrecession year. The overall pattern is fairly clear. Whether looking at market income or at after-tax, after-transfer income, the 80th-99th percentile received about the same share of income in 2007 as in 1979. The top 1% got a notably larger share. Each of the lower four-fifths of the income distribution got a lower share.

There is a modest rise in inequality of annual incomes even leaving out the top 1%, but most of the increase in annual income inequality is being driven by rising incomes of the top 1%. It's perhaps useful to add that pointing out the fact of rising inequality doesn't say anything about underlying causes or possible policies.

For a July 18 post on causes of inequality, see "Causes of Inequality: Supply and Demand for Skilled Workers." For an overview of philosophical and economic arguments about inequality, see the September 30 post, "A Critique of the Arguments for Inequality."

- The gains to the top 1% of the income distribution.

- How the federal role in redistributing income through taxes and transfers has weakened in recent decades.

- An explanation of the Lorenz curve and the Gini coefficient, for those who would like to understand some terminology that is often used when discussing inequality.

While it is certainly true that the top 1% is a group that evolves over time, this point shouldn't be pushed too hard. Inequality as measured by annual income is rising; however, I don't know of any evidence that mobility between broad income groups has been rising. Greater inequality isn't being offset by greater mobility.

Here's a graph showing the cumulative percentage growth in after-tax, after-transfer income for various income groups, measured on an annual basis. Income growth is slowest for t hose in the lowest quintile (or fifth) of the income distribution, and then faster in ascending order for those in the 21st to 80th percentiles, the 81st to 99th percentiles, and the top 1%. The percentage gains for the top 1% are remarkably higher than for the other groups.

One can look at this underlying data in a different way: What share of total market income did these groups receive in 1979, compared to 2007? And what share of after-tax, after-transfer income did these groups receive in 1979, compared to 2007? The timeframe is a useful one, because it runs from one business cycle peak just before a deep recession in 1979 to another year that is a business cycle peak just before a deep recession. Thus, patterns over this time can't be attributed to comparing a recession year to a nonrecession year. The overall pattern is fairly clear. Whether looking at market income or at after-tax, after-transfer income, the 80th-99th percentile received about the same share of income in 2007 as in 1979. The top 1% got a notably larger share. Each of the lower four-fifths of the income distribution got a lower share.

There is a modest rise in inequality of annual incomes even leaving out the top 1%, but most of the increase in annual income inequality is being driven by rising incomes of the top 1%. It's perhaps useful to add that pointing out the fact of rising inequality doesn't say anything about underlying causes or possible policies.

For a July 18 post on causes of inequality, see "Causes of Inequality: Supply and Demand for Skilled Workers." For an overview of philosophical and economic arguments about inequality, see the September 30 post, "A Critique of the Arguments for Inequality."

Friday, September 30, 2011

A Critique of the Arguments for Inequality

The always-thoughtful John E. Roemer gave a talk on "The Ideological and Political Roots of American Inequality" at a conference last February. The talk is available as a working paper here; a revised version of the talk appears as an article with the same name in the September-October issue of Challenge magazine, which is available on-line if your library has a subscription. I quote here from the working paper version.

A First Argument for Inequality: Individuals Deserve to Benefit from Their Endowments

The first argument that Roemer considers for inequality is "an ethical one, that individuals deserve to benefit from what nature and nurture endows them with ... The first argument is presented in its most compelling form by thephilosopher Robert Nozick, who in his 1974 book, Anarchy, State and Utopia, advanced the idea that a person has a right to own himself and his powers, and to benefit by virtue of any good luck that may befall him, such as the luck of being born into a rich family, or in a rich nation. ... Nozick is the first the admit that actual capitalist economies are not characterized by historical sequences of legitimate, voluntary exchanges: there is much coercion, corruption, and theft in the history of all societies. But Nozick’s point is that one can imagine a capitalism with a clean history, in which vastly unequal endowments of wealth are built up entirely from exchanges between highly talented, well educated people and simple, unskilled ones, and this unequal result is ethically acceptable if one accepts the premise that one has a right to benefit by virtue of one’s endowments – biological, familial, and social – or so he claims."

Responses from Rawls and Dworkin to this first argument

"The philosophical response to Robert Nozick’s libertarianism came primarily from two political philosophers, John Rawls and Ronald Dworkin. ... Rawls attempted to construct an argument that, if rational, self-interested beings were shielded from the knowledge of the luck they would sustain in the birth lottery, which assigns genes and families, they would opt for a highly equal distribution of wealth – indeed, for that distribution which maximizes the wealth that the poorest class of people would have. . ... The error in Rawls’s argument that those in an original position, behind a veil of ignorance, would choose a highly equal distribution of income, came from his assumption that the decision makers postulated to occupy this position were completely self-interested. Self-interested individuals may be willing to take some risk in the birth lottery – they may be willing to accept some possibility of an unlucky draw in return for the possibility of a lucky draw. ... This does not mean that a strongly equalizing tax system is ethically wrong: but to justify it with the kind of argument Rawls wished to

construct requires that individuals care at least to some degree about others. Rawls’s attempt to derive equality of results from premises of rationality and self-interest fails. ... There was another aspect of Rawls’s theory that was unattractive to some: there was no evident place in it for the role of personal responsibility and accountable choice. ... Ronald Dworkin, in 1981, published a pair of articles which addressed this problem in a radical, new way. He advocated what he dubbed ‘resource equality’ ... In Dworkin’s view, people should be held responsible for their preferences, but not for their resources – where resources include many of the goods that Rawls called morally arbitrary, such as genetic endowments and the social and familial circumstances of one’s childhood. ... Thus, a degree of equality was recommended that was less than Rawlsian, but far more than exists in most advanced democracies today."

A Second Argument for Inequality: Incentives

The second argument that Roemer considers about inequality is "the instrumental one: that only by allowing highly talented persons to keep a large fraction of the wealth that they help in creating will that creativity flourish, which redounds to the benefit of all, through what is informally called the trickle-down process. In a word, material incentives are necessary to engender the creativity in that small fraction of humanity who have the potential for it, and state interventions, primarily through income taxation, which reduce those material rewards, will kill the goose that lays the golden eggs."

A Response: Contrasting The Market Role in Coordination and Incentives

"Economists have long realized that markets perform two functions: they coordinate economic activity, and they provide incentives for the development of skills and innovations. It is not easy to give a definition which distinguishes precisely between these two functions, but there is no question that a conceptual distinction exists. ... In the last thirty or forty years, the economic theorist’s view of the market has changed, from being an institution which performs primarily a coordination function to one that is primarily harnessing incentives. Indeed, the old definition of micro-economics was the study of how to allocate scarce resources to competing needs. This is entirely a coordination view. ...

It may surprise you to hear that the phrase ‘principal-agent problem’ was only introduced into economics in 1973, in an article by Steven Ross. In the principal-agent problem, coordination is not the primary issue – rather, a principal must design a contract to extract optimal performance from an agent whose behavior he cannot perfectly observe. This is par excellence an incentive problem. ...

"The punch line I am proposing is this: to the extent that the market is primarily a device for coordination, taxation can redistribute income without massive efficiency costs. But if the market is primarily a device for harnessing incentives, the efficiency costs of redistribution may be high. ..Although economic theory has shifted on this question during the last generation, it is far from obvious that the shift is empirically justified – by which I mean, we do not know that the market’s role in incentive provision is as important as current economic theory contends. ..."

"I have argued that these high incomes are inefficient, because of risk-taking externalities that they induce, that they are unnecessary for incentive provision, and that they create a class with disproportionate political power. Finally, there is the very important negative externality of the creation of a social ethos which worships wealth. ... In sum, the positive social value of the institution of extremely high salaries that the leaders of the corporate world, and in particular, of the financial sector, receive, is a big lie. It may well be a competitive outcome, but it is a market failure which could be corrected by regulation or legislation."

A Third Argument for Inequality: Policy Futility

"A third argument for inequality, which is currently most prevalent in the United States, is one of futility: even if the degree of inequality that comes with laissez-faire is not socially necessary in the sense that the incentive argument claims, attempts by the state to reduce it will come to naught, because the government is grossly incompetent, inefficient, or corrupt. ... This is, I think, a particularly American view, so it is probably not appropriate to spend much time on it here."

A First Argument for Inequality: Individuals Deserve to Benefit from Their Endowments

The first argument that Roemer considers for inequality is "an ethical one, that individuals deserve to benefit from what nature and nurture endows them with ... The first argument is presented in its most compelling form by thephilosopher Robert Nozick, who in his 1974 book, Anarchy, State and Utopia, advanced the idea that a person has a right to own himself and his powers, and to benefit by virtue of any good luck that may befall him, such as the luck of being born into a rich family, or in a rich nation. ... Nozick is the first the admit that actual capitalist economies are not characterized by historical sequences of legitimate, voluntary exchanges: there is much coercion, corruption, and theft in the history of all societies. But Nozick’s point is that one can imagine a capitalism with a clean history, in which vastly unequal endowments of wealth are built up entirely from exchanges between highly talented, well educated people and simple, unskilled ones, and this unequal result is ethically acceptable if one accepts the premise that one has a right to benefit by virtue of one’s endowments – biological, familial, and social – or so he claims."

Responses from Rawls and Dworkin to this first argument

"The philosophical response to Robert Nozick’s libertarianism came primarily from two political philosophers, John Rawls and Ronald Dworkin. ... Rawls attempted to construct an argument that, if rational, self-interested beings were shielded from the knowledge of the luck they would sustain in the birth lottery, which assigns genes and families, they would opt for a highly equal distribution of wealth – indeed, for that distribution which maximizes the wealth that the poorest class of people would have. . ... The error in Rawls’s argument that those in an original position, behind a veil of ignorance, would choose a highly equal distribution of income, came from his assumption that the decision makers postulated to occupy this position were completely self-interested. Self-interested individuals may be willing to take some risk in the birth lottery – they may be willing to accept some possibility of an unlucky draw in return for the possibility of a lucky draw. ... This does not mean that a strongly equalizing tax system is ethically wrong: but to justify it with the kind of argument Rawls wished to

construct requires that individuals care at least to some degree about others. Rawls’s attempt to derive equality of results from premises of rationality and self-interest fails. ... There was another aspect of Rawls’s theory that was unattractive to some: there was no evident place in it for the role of personal responsibility and accountable choice. ... Ronald Dworkin, in 1981, published a pair of articles which addressed this problem in a radical, new way. He advocated what he dubbed ‘resource equality’ ... In Dworkin’s view, people should be held responsible for their preferences, but not for their resources – where resources include many of the goods that Rawls called morally arbitrary, such as genetic endowments and the social and familial circumstances of one’s childhood. ... Thus, a degree of equality was recommended that was less than Rawlsian, but far more than exists in most advanced democracies today."

A Second Argument for Inequality: Incentives

The second argument that Roemer considers about inequality is "the instrumental one: that only by allowing highly talented persons to keep a large fraction of the wealth that they help in creating will that creativity flourish, which redounds to the benefit of all, through what is informally called the trickle-down process. In a word, material incentives are necessary to engender the creativity in that small fraction of humanity who have the potential for it, and state interventions, primarily through income taxation, which reduce those material rewards, will kill the goose that lays the golden eggs."

A Response: Contrasting The Market Role in Coordination and Incentives

"Economists have long realized that markets perform two functions: they coordinate economic activity, and they provide incentives for the development of skills and innovations. It is not easy to give a definition which distinguishes precisely between these two functions, but there is no question that a conceptual distinction exists. ... In the last thirty or forty years, the economic theorist’s view of the market has changed, from being an institution which performs primarily a coordination function to one that is primarily harnessing incentives. Indeed, the old definition of micro-economics was the study of how to allocate scarce resources to competing needs. This is entirely a coordination view. ...

It may surprise you to hear that the phrase ‘principal-agent problem’ was only introduced into economics in 1973, in an article by Steven Ross. In the principal-agent problem, coordination is not the primary issue – rather, a principal must design a contract to extract optimal performance from an agent whose behavior he cannot perfectly observe. This is par excellence an incentive problem. ...

"The punch line I am proposing is this: to the extent that the market is primarily a device for coordination, taxation can redistribute income without massive efficiency costs. But if the market is primarily a device for harnessing incentives, the efficiency costs of redistribution may be high. ..Although economic theory has shifted on this question during the last generation, it is far from obvious that the shift is empirically justified – by which I mean, we do not know that the market’s role in incentive provision is as important as current economic theory contends. ..."

"I have argued that these high incomes are inefficient, because of risk-taking externalities that they induce, that they are unnecessary for incentive provision, and that they create a class with disproportionate political power. Finally, there is the very important negative externality of the creation of a social ethos which worships wealth. ... In sum, the positive social value of the institution of extremely high salaries that the leaders of the corporate world, and in particular, of the financial sector, receive, is a big lie. It may well be a competitive outcome, but it is a market failure which could be corrected by regulation or legislation."

A Third Argument for Inequality: Policy Futility

"A third argument for inequality, which is currently most prevalent in the United States, is one of futility: even if the degree of inequality that comes with laissez-faire is not socially necessary in the sense that the incentive argument claims, attempts by the state to reduce it will come to naught, because the government is grossly incompetent, inefficient, or corrupt. ... This is, I think, a particularly American view, so it is probably not appropriate to spend much time on it here."

Thursday, September 29, 2011

How Does Inequality Affect Economic Growth?

Historically, many economists believed that a healthy degree of economic inequality was good for economic growth. Branko Milanovic explains in "More or Less":

In "Why Aren't All Countries Rich?", Jessie Romero of the Richmond Federal Reserve discusses some patterns in this literature. As this figure shows, the Latin America and the Sub-Saharan Africa regions have consistently had the greatest degree of inequality.

Thus, given the relatively slow growth rates in these regions in the 1980s and 1990s, and the comparatively fast growth rates in more-equal Asia, economic research at that time had often claimed a connection between greater inequality and slower growth. However, in 1996, Klaus Deininger and Lyn Squire ("A New Data Set Measuring Income Inequality", World Bank Economic Review, 10(3): 565-91, 1996) pointed out that this kind of comparison across countries didn't control sufficiently for other factors that could vary across regions and countries, like variations in political and social institutions or in initial level of development. In their analysis, with these kinds of factors taken into account, the degree of economic inequality didn't seem to influence subsequent growth.

More recently, Andrew G. Berg and Jonathan D. Ostry have been taking a look at the relationship between inequality and the length of periods of economic growth, and their readable summary of their results is here. They write (citations and references to charts have been cut):

In their work, interestingly enough, income inequality and trade openness are major factors in determining how long periods of growth will last, while political institutions and foreign direct investment are of intermediate importance, and external debt and exchange rate competitiveness are of little importance.

"The view that income inequality harms growth—or that improved equality can help sustain growth—has become more widely held in recent years. ... Historically, the reverse position—that inequality is good for growth—held sway among economists. The main reason for this shift is the increasing importance of human capital in development. When physical capital mattered most, savings and investments were key. Then it was important to have a large contingent of rich people who could save a greater proportion of their income than the poor and invest it in physical capital. But now that human capital is scarcer than machines, widespread education has become the secret to growth. And broadly accessible education is difficult to achieve unless a society has a relatively even income distribution. Moreover, widespread education not only demands relatively even income distribution but, in a virtuous circle, reproduces it as it reduces income gaps between skilled and unskilled labor. So economists today are more critical of inequality than they were in the past."The economic literature on the possible causal relationship between inequality and growth seems to have gone from arguing for such a connection in the 1980s and early 1990s, to arguing that the connection wasn't so important in the mid-1990s, and now back to arguing that it may be important.

In "Why Aren't All Countries Rich?", Jessie Romero of the Richmond Federal Reserve discusses some patterns in this literature. As this figure shows, the Latin America and the Sub-Saharan Africa regions have consistently had the greatest degree of inequality.