At least for a time, one legacy of the pandemic is likely to be a decrease in physical connections around the world economy, from tourism and business travel to shipping objects. But international trade in services is delivered online. For the US, trade in services has been becoming a bigger part of the overall trade picture, and the pandemic may give it an additional boost. Alexander Monge-Naranjo and Qiuhan Sun provide some background in "Will Tech Improvements for Trading Services Switch the U.S. into a Net Exporter?" (Regional Economist, Federal Reserve Bank of St. Louis, Fourth Quarter 2020).

The authors point out that shifts in transportation routes or shipping method like containerization have had large effects on international trade in the past. They write:

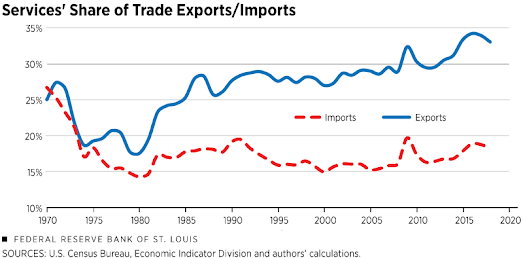

The U.S. is a world leader in most high-skilled professional service sectors, such as health, finance and many sectors of research and development. Moreover, leading American producers have been ahead of others in the adoption of ICT in their production networks. The global diffusion of ICT—including possibly the expansion of 5G networks—is prone to make many of these services tradeable for servicing households and businesses.... Similarly, the day-to-day activities of many businesses all involve tasks that can be automated and/or performed remotely and, of course, across national boundaries. Thus, a natural prediction would be that the U.S. should become a net exporter of high-skilled, knowledge-intensive professional services because of its comparative advantage.Here are some illustrations of the patterns already underway. This figure shows the US trade balance separating out goods and services. The US trade deficit in goods plummetted from the early 1990s up to about 2006--with an especially sharp drop after China entered the World Trade Organization in 2001 and China's global exports exploded in size. But notice that US trade in services has consistently been running a trade surplus over this time, and the services trade surplus has been rising in recent years. Indeed, the long-run pattern seems to be that for the US economy, services have stayed about the same proportion of total imports in recent decades, but have become a rising proportion of total exports. Some of the big areas of gains for US services exports have been information technology and telecommunications services, insurance and financial services, and other business services (which includes areas like "professional and management consulting, technical services, and research and development services").

Monge-Naranjo and Sun don't actually make a case that a rise in services exports could be enough to turn the overall US trade deficit into a surplus; in that sense, the title of their short article overstates their case. But they do show that trade in services is not only a large and rising part of US exports, but may be the part of US economic output with the biggest upside for expanding US exports in the future.

Supporting this potential for rising US exports in services requires a different public-sector actions. It's not about better transportation systems for physical goods, but rather about faster and more reliable virtual connections across the US and to other places around the world. A substantial and ongoing improvement in this virtual infrastructure also seems potentially quite important for the US economy as it adapts to a new reality of online meetings, online healthcare, online education, online retail, online work-from-home, and more. The US economy isn't going to move back to its manufacturing-dominant days of several decades ago, and at least in the medium-term, it probably isn't going to move back to to the social-clustering times way back in January 2020, either.

In addition, there is "A Fundamental Shift in the Nature of Trade Agreements," as I called it in a post a few years ago, where the emphasis is less about tariffs and import quotas, and more about negotiating the legal and regulatory frameworks to open up foreign markets for US exporters of services. The kinds of trade agreements needed to facilitate, say, US insurance companies operating overseas, are quite different from the trade agreements about tariffs on objects like tariffs or steel.