I've known some true socialists. But the overwhelming majority of the people I run into who talk a "socialist" game aren't actually in favor of having the government own the means of production, which includes the government making decisions about what will be produced and how it is priced--and which might also be taken to include government decisions about who gets hired, what jobs they do, what workers get paid, what rate of return is paid on invested money.

Instead, most of the self-labelled socialists I meet are in favor of a policy agenda that includes a greater emphasis on social protection and a reduction in economic inequality. Referring to "socialism" gives them that college-sophomore thrill of being daringly different and appalling the bourgeoisie. But when asked for real-world examples, they do not typically point to other countries which display primarily government ownership of the means of production. Instead, they point to national health insurance and to various European countries--in particular, to northern European countries like Sweden, Denmark, Norway, and sometimes Finland.

The true socialists I know see this point of view as selling out to capitalism. And the Scandinavians themselves are quick to say that they are not an example of socialism. For example, the prime minister of Denmark gave a talk at Harvard back in 2015 and said:

"I know that some people in the US associate the Nordic model with some sort of socialism. Therefore I would like to make one thing clear. Denmark is far from a socialist planned economy. Denmark is a market economy ... The Nordic model is an expanded welfare state which provides a high level of security for its citizens, but it is also a successful market economy with much freedom to pursue your dreams and live your life as you wish,”Or as Paul Krugman wrote last week in his New York Times column in a discussion of the standards of living in northern European countries: "[T]hey aren’t `socialist,' if that means government control of the means of production. They are, however, quite strongly social-democratic."

Of course, at some level the "socialist" or "capitalist" labels is not really the issue here. If we avoid the s-word and instead just refer to a Scandinavian style of capitalism, what are some of the key elements of that economic model?

Before digging into those elements, it's worth noting that just because the Sweden and Denmark and Norway are countries, and the United States is also a country, public policy may not be easily transplantable between the two. For perspective, the combined population of Sweden (population 10 million) Denmark (population 5.8 million), Norway (5.3 million) is roughly equal to the 20.3 million people who live in the greater New York City metropolitan area (that is, the New York-Newark-Jersey City, NY-NJ-PA Metro Area). These countries have close economic ties to the much larger European Union, which clearly helps trade with close neighbors, but have kept their own currencies and don't use the euro. Norway has considerable oil wealth.

It's also worth noting that the Scandinavian style of capitalism has gone through several stages in the last 50 years ago. For a nice overview how these changes played out in Sweden, I recommend the article by the Swedish economist Assar Lindbeck, "The Swedish Experiment, which appeared in the September 1997 issue of the Journal of Economic Literature (35:3, 1273-1319, available via JSTOR or here). Lindbeck tells the story of how Sweden had relatively rapid growth after about 1870. He writes:

Increasingly ambitious welfare state arrangements and full employment after World War II also provided exceptionally high economic security, generous provision of public-sector services, and a relatively even distribution of income. It therefore seems natural that, especially during the early postwar decades, Sweden was generally regarded as having been able to combine economic equality, generous welfare state benefits, and full employment with high economic efficiency and rather fast productivity growth. But slower economic growth from about 1970, a collapse of full employment in the early 1990s, a recent widening of income differentials, and retreats of various welfare-state benefits have made the picture of the "Swedish model" less idyllic.Lindbeck describes a number of problems that arose, including "disincentive effects, problems of moral hazard and cheating with taxes and benefits, deficiencies in competition in markets for products and services, as well as inflexible relative wages .... [and] the ever higher ambitions of politicians to expand various government programs, and the gradually rising ambitions of union officials to compress the distribution of wages as well as to expand the powers of unions."

Writing in 1997, Lindbeck describes how Sweden had come to grips with these issues earlier in the 1990s. For example, there was a broad recognition that as a small open economy, Sweden needed healthy companies with an exchange rate that let them be competitive in global markets. Many government benefit programs were rolled back. The pension system was redesigned to limit its growth. There was a ceiling on public spending. Sweden's ratio of GDP to national debt ratio has been falling from 80 per cent in 1995 to 41 per cent in 2017. In short, the Swedes themselves didn't think that the Swedish system was working all that well in the 1980s and early 1990s, and carrried out a substantial hard-headed resdesign.

It's hard to sum up the Scandinavian system of capitalism and its key tradeoffs in a few words. because the system is different from a US model in so many ways. Here, I'll take a look from three different angles.

First, the Scandinavian model of capitalism offers a lot more social protection and economic equality--and it also clearly recognize that this means that average people need to pay more in taxes. The overall tax burden in the Scandinavian countries is almost half, while the combined spending of all levels of government in the US is about 38% of GDP.

First, the Scandinavian model of capitalism offers a lot more social protection and economic equality--and it also clearly recognize that this means that average people need to pay more in taxes. The overall tax burden in the Scandinavian countries is almost half, while the combined spending of all levels of government in the US is about 38% of GDP.

In the US, there is sometimes a claim that a Scandinavian level of social protection can be financed by taxing corporations and the rich. The Scandinavians themselves gave up on that idea back in the 1990s. As small open economies, dependent on exporting firms, the Scandinavian countries choose not to have high corporate taxes. Given that these countries have a much more equal distribution of income to begin with, and wants to attract companies and entrepreneurs, collecting a large share of GDP by "taxing the rich" isn't a realistic option. Indeed, Sweden recently abolished its estate tax. On the distribution of taxes in these countries, an October 2018 report from the Council of Economic Advisers recently noted (footnotes omitted:

"The Nordic countries themselves recognized the economic harm of high tax rates in terms of creating and retaining businesses and motivating work effort, which is why their marginal tax rates on personal and corporate income have fallen 20 or 30 points, or more, from their peaks in the 1970s and 1980s. ...

Regardless of whether they are rich, poor, or in between, Nordic households are required to pay an additional VAT of 24 or 25 percent on their purchases, on top of all the other taxes that they pay. By comparison, sales taxes vary by U.S. State, but none is that high, and the national average rate is about 6 percent.

Even without the VAT, the high Nordic rates apply to everyone, not just the rich. The OECD prepares a measure of progressivity that is the share of nationwide household taxes paid by the top 10 percent of citizens (ranked by their income), expressed as a ratio of the share of national aggregate income. The ratio would be 1 if the household taxes were a fixed proportion of income. A regressive (progressive) tax would have a ratio less (greater) than 1, respectively. ... Four of the Nordic countries have essentially proportional household taxes. The average progressivity of all five countries is 1.01, which is 0.34 less progressive than in the U.S."

A second angle on the Scandinavian model of capitalism is to look at how these high taxes on average workers serve to finance lots of government programs and services that have a tendency to encourage employment. Henrik Jacobsen Kleven made this argument in "How Can Scandinavians Tax So Much?" in the Fall 2014 issue of the Journal of Economic Perspectives. Kleven calculates what he calls the "participation tax rate," which is basically how much workers improve their income level by participating in the labor market, after taxes and the loss of benefits is considered. Kleven writes:

The contrast is even more striking when considering the so-called “participation tax rate,” which is the effective average tax rate on labor force participation when accounting for the distortions due to income taxes, payroll taxes, consumption taxes, and means-tested transfers. This tax rate is around 80 percent in the Scandinavian countries, implying that an average worker entering employment will be able to increase consumption by only 20 percent of earned income due to the combined effect of higher taxes and lower transfers. By contrast, the average worker in the United States gets to keep 63 percent of earnings when accounting for the full effect of the tax and welfare system.

Kleven also focuses on government policies that can be thought of as encouraging people to work--in particular, "provision of child care, preschool, and elderly care. He writes:

Even though these programs are typically universal (and therefore available to both working and nonworking families), they effectively subsidize labor supply by lowering the prices of goods that are complementary to working. That is, working families have greater need for support in taking care of their young children or elderly parents. ... [H]igher public support for preschool, child care, and elder care is positively associated with the rate of employment. Moreover, the Scandinavian countries are strong outliers as they spend more on such participation subsidies (about 6 percent of aggregate labor income) than any other country. ... Broadly speaking, countries tend to be divided into those with relatively small tax-transfer distortions and at the same time small subsidies to child care and elderly care (such as the United States and countries of southern Europe) and those with a lot of both (like the countries of Scandinavia).

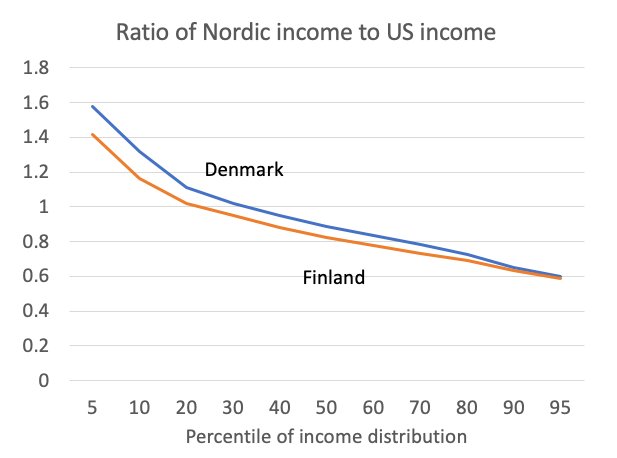

A third angle on the Scandinavian model of capitalism is presented in the recent op-ed column by Paul Krugman mentioned above. He presents a useful figure put together by Janet Gornick, which seeks to estimate the income level for people at different points in the income distribution for the Nordic countries and the US. The essential message of the figure is that below about the 30th percentile of the income distribution, income levels are higher in Nordic countries, thus showing both the greater equality of wages and greater government support for economic equality in those countries. For perspective, the 30th percentile of the US income distribution is roughly $32,000 per year.

The figure is worth contemplation. Just to to be clear, the underlying data seeks to measure income after taxes are paid and after transfer payments are received: in a US context, this means "including all cash transfers and several near-cash and non-monetary components as well: SNAP, LIHEAP, housing vouchers, school lunches, also EITC." However, health care benefits provided through government programs would not be counted, in either the Scandinavian or US context. (The omission is interesting to consider. US health care spending per person is so much more than in other countries that including Medicaid in the US and government-funded health care spending in the Scandinavian countries would probably close the gap at lower levels of income to some extent.)

The figure uses a ratio on the vertical axis, and it's useful to focus on what that means. Consider a low-income person at the 10-20th income percentile: the people at that location in the income distribution in Denmark or Finland have income about 20% above the US person at that place in the income distribution. Now think about those a little above the middle of the income distribution in the the 55th-60th percentile, where those in Finland and Denmark are 20% below the similar person located at the same place in the US income distribution. The percentages are the same--20% higher, 20% lower--but the absolute amounts are not. After all, 20% higher applies to low incomes, and so it's going to be substantially less than the 20% higher applied to middle incomes. Thus, if measured in absolute terms, the amount that those at the top of the US income distribution are above the Nordic countries would be a lot more than the amount that those at the bottom of the US income distribution are below those in the Nordic countries. The figure thus does not reveal that average income levels are about 20% higher in the United States.

The figure uses a ratio on the vertical axis, and it's useful to focus on what that means. Consider a low-income person at the 10-20th income percentile: the people at that location in the income distribution in Denmark or Finland have income about 20% above the US person at that place in the income distribution. Now think about those a little above the middle of the income distribution in the the 55th-60th percentile, where those in Finland and Denmark are 20% below the similar person located at the same place in the US income distribution. The percentages are the same--20% higher, 20% lower--but the absolute amounts are not. After all, 20% higher applies to low incomes, and so it's going to be substantially less than the 20% higher applied to middle incomes. Thus, if measured in absolute terms, the amount that those at the top of the US income distribution are above the Nordic countries would be a lot more than the amount that those at the bottom of the US income distribution are below those in the Nordic countries. The figure thus does not reveal that average income levels are about 20% higher in the United States.

Of course, income isn't everything. I mentioned above the availability of preschool, child care, and elder care services. US workers have much less vacation than those in European countries in general countries. Parental leave is much longer in European countries.

If you want to cite the Scandinavian countries as an economic model for the US, that's of course fine--but then you should also feel some obligation to be aware of what that model actually includes. I've already mentioned parts of that model: strong support for international trade and participation in global markets; much higher taxes on the middle class, and lower taxes on corporations; much higher levels of social services and benefits related to labor market participation. It's a model where the decisions about production, investment, pricing, job choice, and consumption happens in the context of private-sector decision-makers.

For advocates for a higher US minimum wage, it's perhaps worth noting (as the CEA report notes) that the "Nordic countries do not have minimum wage laws, although the vast majority of jobs have wages limited by collective bargaining agreements." Rates of unionization are typically in the range of 70-90% of the workforce in Norway, Denmark, and Sweden, as opposed to about 11% of the US workforce. Of course, negotiating pressure from these unions is a powerful reason for the greater equality of wages and benefits for labor.

"The same OECD study estimates that, while many American students pay tuition, Americans are somewhat more likely to attain tertiary education on average. In comparison with the tertiary schooling returns in the Nordic countries, American college graduates get their tuition back with interest, and also a lot more. To put it another way, the rates of return to a college education in Nordic countries are low, and propensities to invest are not high, despite the fact that such an investment requires no tuition payments out of pocket."

Sweden's social security system is based on mandatory contributions to individual accounts, with people having a wide range of several hundred possible investment options for their account, or a default fund mostly invested in stocks.

The Scandinavian countries do have national programs of health insurance coverage, but in these systems, users of health care typically have substantial co-payments with an annual cap for health care spending. For example, OECD data suggests that out-of-pocket health care spending is only a little lower in Norway than in the United States.

I'm all for studying alternative approaches to capitalism, considering the tradeoffs, and seeing what lessons can be learned. I suspect that a number of the lessons to be learned from studying the actual real-world Scandinavian style of capitalism are different from what many Americans might expect.