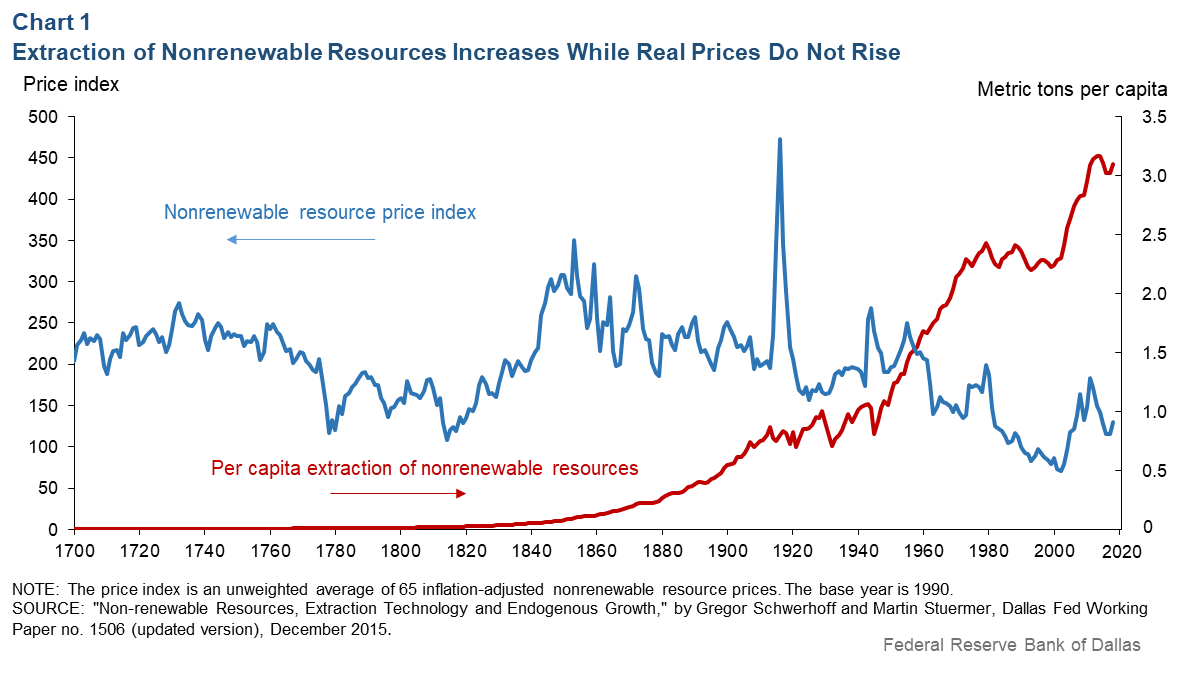

But this intuition is apparently wrong. Output of nonrenewable resources has risen substantially over the long-run, but prices have fallen. Sean Howard, Gregor Schwerhoff and Martin Stuermer of the Federal Reserve Bank of Dallas discuss possible reasons in "Solving a Puzzle: More Nonrenewable Resources Without Higher Prices" (August 27, 2019). To set the stage, here is a chart where the red line shows combined extraction of 65 nonrenewable resources from 1700 to the present, and the blue line shows an index of the overall change in prices.

Their proposed explanation is built on how new technologies for extracting nonrenewable resources interact with a common geological pattern. . They agree that when extracting nonrenewable resources, the least-expensive will tend to go first. However, it is a common geological pattern that there is relatively little of any resource that are easy to extract at low cost. As one moves to nonrenewable resources that can only be extracted at higher cost, there tend to be a greater quantity of these resources.

Because of this geological pattern, each new technology that comes along for reducing the cost of extracting nonrenewable resources tends to open up possibilities for accessing a greater quantity of such resources. They write:

L.H. Ahrens and his fundamental law of geochemistry states that greater quantities of a resource are locked in more troublesome lower grades, which in turn implies that a new technology’s higher development costs may be mitigated by the ever-greater supply of the resource it opens.

A practical example of this is the shale oil revolution in 2014. Although the development of hydraulic fracturing technology was most likely costlier than the development of earlier conventional methods, there is more unconventional oil. The International Energy Agency estimates there are 1.5 trillion barrels of crude oil in conventional or high-grade deposits and 4.5 trillion barrels in unconventional or low-grade deposits, including natural gas liquids. Although the technology required to extract unconventional oil is more expensive to develop, there is much more of the resource of this grade to

extract.

The result of this interplay between extraction technology and geology is an equilibrium of an increasing abundance of economically extractable nonrenewable resources at nonincreasing prices.Of course, this insight is only part of thinking more broadly about the economics of nonrenewable resources. A past pattern of rising quantities of nonrenewable resources combined with stable-to-falling prices offers no guarantee that the pattern will persist into the future, or that it will persist for individual resources as opposed to overall averages. But while there are no guarantees, it also suggests a reason why this pattern could possibly persist for decades to come.