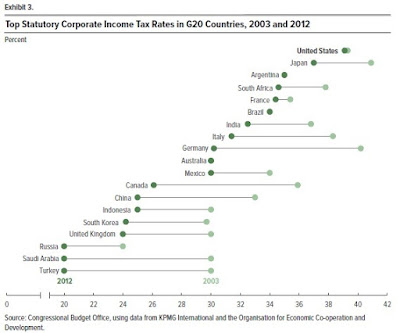

Here's a graph showing top corporate tax rates across countries, with the light green dot showing the top rate in 2003 and the darker green dot showing the top rate in 2012. The US corporate tax rate is at the top of the list, and it's clear that many other countries have cut their corporate tax rates substantially since the early 2000s.

Here's a graph showing the "effective marginal corporate tax rate," which is "a measure of a corporation’s tax burden on returns from a marginal investment (one that is expected to earn just enough, after taxes, to attract investors)." On this measure, the US is only fourth-highest among the comparison group of countries.

Given the lower tax rates in other countries, it's perhaps not a surprise that although although the number of public companies listed on US stock exchanges has fallen by half in the last 20 years, the number of US-owned companies in a number of other countries has been rising.

It's also probably no surprise that an increasing share of US firms are choosing to organize themselves as "S corporations," in which profits are passed through directly to the owners and taxed only through the individual income tax, thus avoiding the corporate income tax (see here and here).

There seems to be fairly broad agreement that the US corporate income tax needs fixing. For example, here's a discussion of "Corporate Tax Reform: The Opening Obama Administration Bid" (February 3, 2015), and I offer some discussion of the destination-based cash-flow tax that House Republicans have proposed for corporate tax reform in "Border Adjustments, Tariffs, VAT, and the Corporate Income Tax" (January 31, 2017). But the fundamental problem, it seems to me, is that a lot of American tend to think of the corporate income tax as a sort of magic money that comes from "the corporations" without any meaningful tradeoffs or costs for actual workers or producers or investors. The rest of the world is showing, by their decisions to reduce top corporate tax rates, that they perceive some of those tradeoffs.